Supply tightness and increased demand from China have seen noble alloy prices rise quickly at the start of 2021, and there is scope for further gains this year with industrial production set to recover further and multiple end-use sectors signalling robust growth potential.

Chinese imports of ferro-molybdenum, ferro-titanium and ferro-vanadium have all risen significantly, with October volumes up by almost nine times, three times and 25pc year on year at 400t, 736t and 545t, respectively, Global Trade Tracker data show. These upticks did not immediately translate into higher spot prices because of lockdown restrictions continuing to stifle activity elsewhere in the world, with prices for the aforementioned metals down on the year by 24pc, 6pc and 11pc, respectively, as of 1 October.

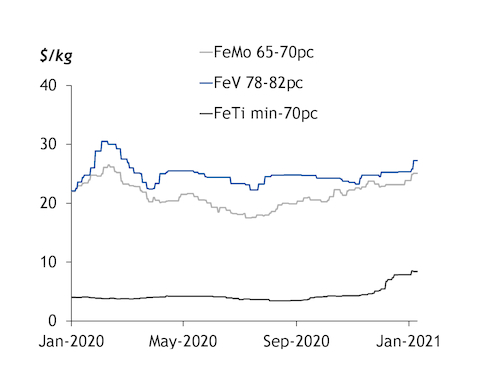

That said, late last week in Europe Argus assessed prices for ferro-molybdenum at $24.95-25.20/kg dp Rotterdam, up from $22.70-23.20/kg a year earlier. The Rotterdam assessment for western grade min 70pc ferro-titanium has risen to $8.00-8.80/kg from $3.90-4.10/kg over the same period — also bolstered by the severe shortage of titanium scrap — and ferro-vanadium has climbed to $27.00-27.50/kg dp Rotterdam from $22.10-23.00/kg.

In the near term, it remains to be seen how China’s lunar new year holiday will impact prices both within China and elsewhere, with some market participants wary that already-limited spot supply of ferro-vanadium in particular might tighten further as China’s operations pause. Meanwhile, the ferro-tungsten market continues to grapple with a scarcity of Russian supply amid winter weather conditions and specific financial challenges. But in the longer term, it is the demand side of the equation for steel-hardening alloys that appears particularly robust and likely to underpin further price gains for the year ahead.

China’s energy infrastructure upgrades

China’s energy industry is undergoing a renaissance, from an already high and modern base, with many oil and gas companies expanding their facilities in pursuit of greater productivity and competitive advantages — all of which point to robust appetite for ferro-alloys in the future.

Chinese state-controlled oil firms are investing in more refinery upgrades to boost product quality and increase petrochemical yields. They include state-controlled Sinopec’s 270,000 b/d Yanshan refinery in Beijing, which is being upgraded to produce cleaner fuels for chemical production. PetroChina’s 320,000 b/d Lanzhou refinery in northwest China’s Gansu province plans to raise jet fuel and petrochemical yields. And Sinopec’s 470,000 b/d Maoming refinery has also started up a new residue hydrocracker to convert more heavy oil and residues into clean fuels.

All of these expansions will require increased use of ferro-alloys and China is busy purchasing the necessary raw materials while other nations are preoccupied and paralysed by Covid-19 lockdowns. Market participants are quick to note that China previously imported high volumes of raw materials during the financial crisis of 2008-09 — molybdenum oxide in particular — and expect China to also import increased volumes at more downstream stages of alloy production.

Construction sector demand steady

Machinery and construction also bridge the industrial use-case between molybdenum, tungsten and vanadium. Around 91pc of vanadium is used in rebar production and almost all rebar products are destined for use in steel structures — whether that is formwork, concrete or reinforcement applications.

Higher grades of rebar tend to hold a higher intensity of vanadium, and China is increasing its use of these types of products as it modernises the infrastructure to provide superior, greener and safer high-density housing. In 2018, China mandated that grade-three steel would need to increase its vanadium content to 0.03pc and grade-five steel would need contain more than 0.1pc. These regulations are helping to further bolster demand expectations as import restrictions on vanadium-bearing slags continue and plans for Vanadium-Redox Flow Batteries press forward.

China’s construction industry continues to support substantial growth in steel and alloy demand but is not increasing activity year on year. The quantity of floor space fell by 7pc over the year to November, although still totalled around 1.47bn square metres, National Bureau of Statistics data show. Investment in the sector continues despite plunging by 16.3pc year on year in February 2020, and accelerated throughout the fourth quarter of last year to achieve 6pc year-on-year growth in November.

China’s construction sector promises to be a strong source for ferro-alloy demand in 2021 as credit generation in China continues at a double-digit rate and with broad money (M2) standing at 10.7pc in November 2020. M2 is a measure of the money supply that includes cash, checking deposits and easily convertible near money, and is a reflection of how much liquidity is available to industry. With increased M2, developers can take more risks on new projects, but new controls on property loans could restrict that behaviour and impede sectoral growth.

Ferro-molybdenum anchored in energy demand percentage

Vanadium mainly in construction percentage