This article will reflect on the compensation paid to George E. Glasier who has served as CEO of Western Uranium & Vanadium Corp. (CSE:WUC) since 2014. This analysis will also assess whether Western Uranium & Vanadium pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

How Does Total Compensation For George E. Glasier Compare With Other Companies In The Industry?

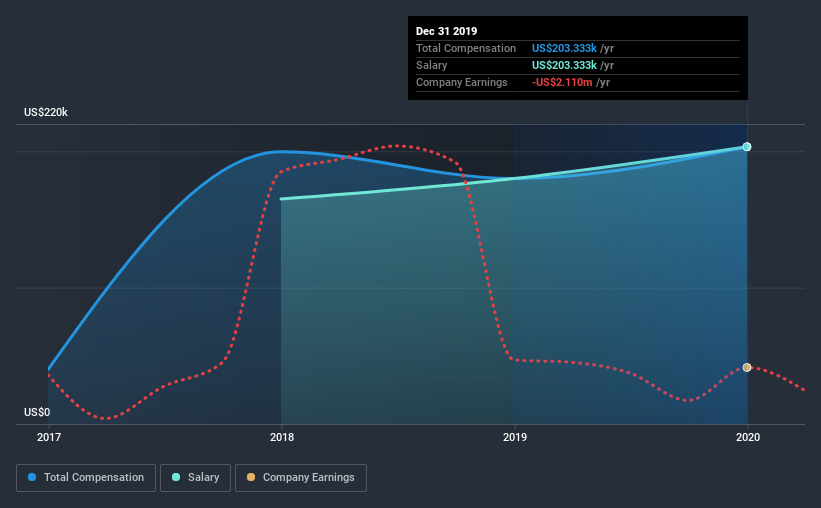

Our data indicates that Western Uranium & Vanadium Corp. has a market capitalization of CA$14m, and total annual CEO compensation was reported as US$203k for the year to December 2019. Notably, that’s an increase of 13% over the year before. It is worth noting that the CEO compensation consists entirely of the salary, worth US$203k.

For comparison, other companies in the industry with market capitalizations below CA$272m, reported a median total CEO compensation of US$280k. This suggests that Western Uranium & Vanadium remunerates its CEO largely in line with the industry average. What’s more, George E. Glasier holds CA$2.3m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$203k | US$180k | 100% |

| Other | – | – | – |

| Total Compensation | US$203k | US$180k | 100% |

On an industry level, roughly 44% of total compensation represents salary and 56% is other remuneration. At the company level, Western Uranium & Vanadium pays George E. Glasier solely through a salary, preferring to go down a conventional route. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Western Uranium & Vanadium Corp.’s Growth

Western Uranium & Vanadium Corp.’s earnings per share (EPS) grew 11% per year over the last three years. Its revenue is down 7.5% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. We don’t have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Western Uranium & Vanadium Corp. Been A Good Investment?

Given the total shareholder loss of 56% over three years, many shareholders in Western Uranium & Vanadium Corp. are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude…

Western Uranium & Vanadium rewards its CEO solely through a salary, ignoring non-salary benefits completely. As we noted earlier, Western Uranium & Vanadium pays its CEO in line with similar-sized companies belonging to the same industry. At the same time, the company has logged negative shareholder returns over the last three years. But on the bright side, earnings growth is positive over the same period. Considering positive earnings growth, we’d say compensation is fair, but shareholders may be wary of a bump in pay before the company logs positive returns.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That’s why we did our research, and identified 5 warning signs for Western Uranium & Vanadium (of which 3 are a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Promoted

If you’re looking to trade Western Uranium & Vanadium, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

www.simplywall.st