Date: Dec 17, 2018

www.ferroalloynet.com: Last week, vanadium market continued to be in state of standoff and the price decline was shrunken. On the one hand, the market lacked of transaction price references. On the other hand, some vanadium manufacturers make no quotation amid the low spot demand. European vanadium market followed Chinese domestic market to slump but the prices were still higher than China. Last Friday, three major manufacturers of V2O5 quoted 250000 rmb/ton by acceptance, which might bring some confidence to vanadium companies.

Steel mills’ bidding prices for December

| Company | Product | Price(RMB/TON) | QTY(TON) | Basis |

| Shandong-based steel mill | Vanadium-nitrogen | 509000 | 150 | Acceptance, tax inclusive |

| Shaangang | Vanadium-nitrogen | 550000 | 30 | Acceptance, tax inclusive |

| SISG | Vanadium-nitrogen | 430000 | 100 | Cash, tax inclusive |

| Xinxing Pipes | Vanadium-nitrogen | 420000 | 10 | Acceptance, tax inclusive |

| BX Steel | Vanadium-nitrogen | 397800 | 30 | Acceptance, tax inclusive |

| KISC | Vanadium-nitrogen | 322000 | 10 | Cash, tax inclusive |

China vanadium market overview

China ammonium metavanadate market

Ammonium metavanadate price decline slowed down gradually last week. Lacking of transaction prices, the market offering prices were chaotic. The offers in Chongyang region were lower and some transactions were made at this level.

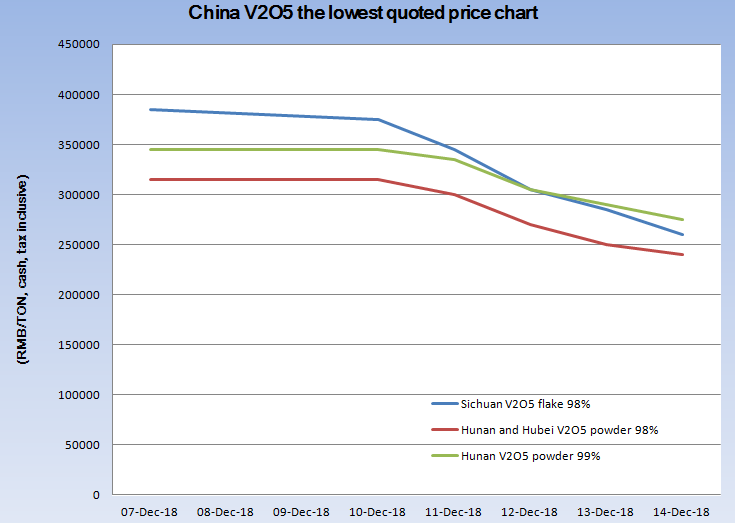

China vanadium pentoxide market

Last week, Liaoning Hongjing and Qichuan Yudian had inventories of vanadium pentoxide flake but didn’t quote openly. They thought their offers were meaningless when there was no price guide and no buying activity. Some traders undersold V2O5 flake and there are small tonnages sold at low price of 220000-230000 rmb/ton by cash. Last Friday, Tranvic, Jianlong and Desheng quoted 250000 rmb/ton by acceptance.