Date: Dec 4, 2018

Vanadium China spot prices rise dramatically from ~USD 20/lb to above USD 33/lb in October 2018.

An update on vanadium demand and supply issues.

An update on some vanadium miners to consider.

Looking for a portfolio of ideas like this one? Members of Trend Investing get exclusive access to our model portfolio. Start your free trial today »

This article was first published on Trend Investing on October 29, 2018, therefore all data is as of that date.

For some background on the vanadium miners, you can read:

- March 2, 2018 – Companies To Benefit From The Stationary Energy Storage Boom

- March 16, 2018 – A Look At The Vanadium Boom And Vanadium Miners

- April 5, 2018 – Top 5 Vanadium Miners To Invest In The Vanadium Boom

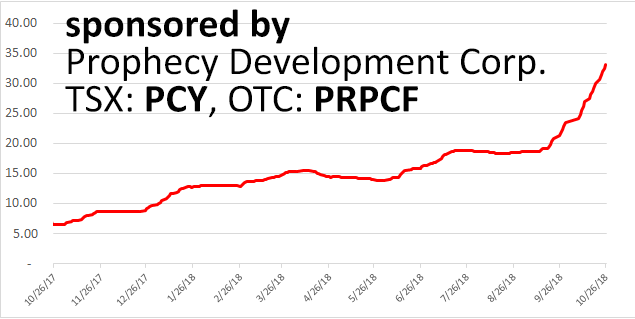

Back when I first wrote on the vanadium boom in March 2018, the vanadium China spot price was rising and had already reached USD 14.10/lb. As you can see below, it is now more than double that at USD 33.10/lb.

Vanadium oxide spot price history

China Vanadium Pentoxide [V2O5] Flake 98{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Price – USD 33.10/lb

(Source: Vanadiumprice.com)

Why vanadium spot prices have been increasing

Vanadium demand

The main reason for the China vanadium spot price increase has been the country’s rule changes to strengthen steel rebar, hence requiring vanadium. The enforcement of China’s new rebar standard and the central government’s special action to cut down on low-quality steel comes into effect next month (November), which should further support the vanadium market. The second, and much smaller, factor is the new vanadium demand for vanadium redox flow batteries (VRFBs). So essentially, the vanadium market is experiencing a strong demand pull.