Date: Nov 23, 2018

www.ferroalloynet.com: This week, the market prices of all vanadium products are decreased at different extent. Steel mills release low consumer demand and the market activity is thin. Some traders search for the goods for steel mills but just inquire. Steel mills are restrained in production in winter and some of them still have small tonnages of vanadium-nitrogen, hence their purchase quantity is quite small. Thus, more and more sellers undersell and the market prices keep dropping.

Steel mills’ bidding prices for November

| Company | Product | Price(RMB/TON) | QTY(TON) | Basis |

| Laiwu Steel | Vanadium-nitrogen | 788000 | 180 | Acceptance, tax inclusive |

| Hebei Jinye | Vanadium-nitrogen | 760000 | 20 | Acceptance, tax inclusive |

| Xinyang Iron&Steel | Vanadium-nitrogen | 760000 | 20 | Acceptance, tax inclusive |

| Jin Gang | Vanadium-nitrogen | 750000 | 20 | Acceptance, tax inclusive |

| NXSG | Vanadium-nitrogen | 750000 | 30 | Acceptance, tax inclusive |

| Wuhu Xinxing Pipes | Vanadium-nitrogen | 760000 | 10 | Acceptance, tax inclusive |

| Anyang Yongxing | Vanadium-nitrogen | 745000 | 10 | Acceptance, tax inclusive |

| BX Steel | Vanadium-nitrogen | 775000 | 40 | Acceptance, tax inclusive |

China vanadium market overview

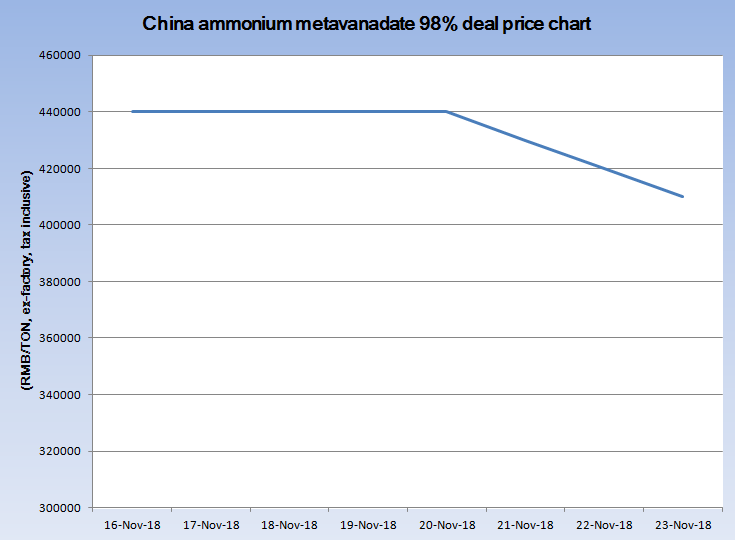

China ammonium metavanadate market

Ammonium metavanadate prices go down sharply and are varied in a range of 300000-350000 rmb/ton without tax. Manufacturers and traders rush to sell but the transactions are quite few. The downstream alloy factories have no fresh orders and dare not replenish raw materials. The market has been in gridlock.