Date: Nov 22, 2018

While the world’s commodity markets and the broader stock markets weather a jittery season of lower lows and seething dread, there is one relatively obscure metal that is doing just fine, thank you: vanadium.

The minor metal that is a key ingredient in advanced steelmaking is seeing record price highs as we go to press in mid-November.

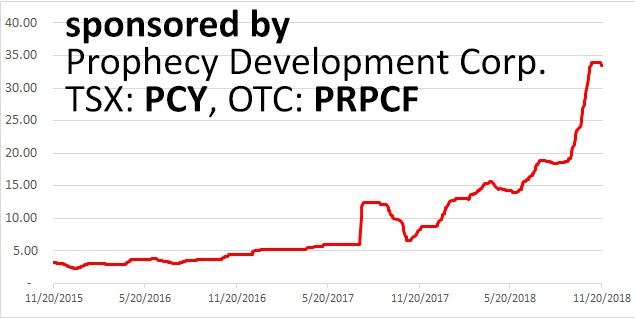

Three-year chart of vanadium pentoxide price in US$ per pound. Credit: vanadiumprice.com

A three-year price chart of vanadium pentoxide (V2O5) 98% flake at www.vanadiumprice.com (a website sponsored by Prophecy Development) shows a classic exponential rise from multi-year lows around US$3 per lb. V2O5 in January 2016 to an all-time high of US$33.40 per lb. on Nov. 20, 2018, for a 10 bagger that happened quietly on the sidelines of the mining industry.

And prices were below US$20 per lb. as recently as September. Apparently what has driven this latest step up in price is a new requirement in China that — as of November 2018 — steel rebar used in the country must have at least some quantity of vanadium to increase the rebar’s stiffness and improve building quality in the country, where building standards have lagged behind those in the West.

In short, vanadium-free, grade-two rebar is being phased out in China.

While 90% of vanadium mine production ends up in steel, the metal also has a role in large-scale battery storage technology, and can be lumped in with the other “battery minerals” lithium, cobalt and nickel.