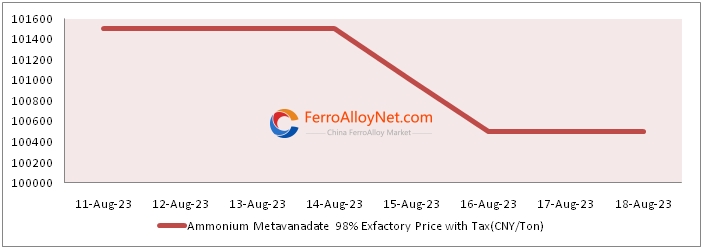

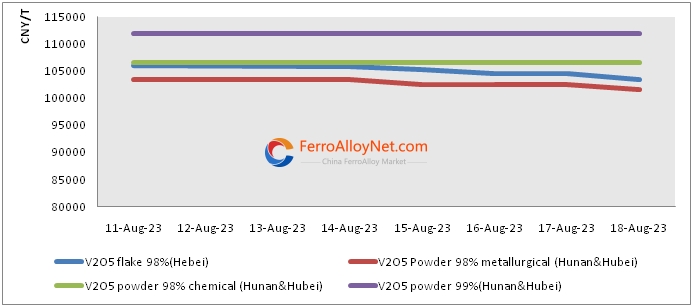

www.ferroalloynet.com: This week, the turnover in the vanadium market continued to drop slightly, and the transaction price of vanadium products fell by 1,000-3,500 CNY/T. Due to the lack of steel recruitment in the middle of the month and the loosening of raw material prices, the overall transaction of vanadium nitrogen alloys fell under pressure to 159,000-160,000 CNY/T by acceptance. The transaction pace of ferrovanadium has slowed down, and the mainstream price has slightly loosened to 115,000-116,000 CNY/T by acceptance. The high pressure on alloy production costs has led to a continuous decline in V2O5 flakes purchase expectations. Some V2O5 flakes retail investors offered to sell at lower prices one after another, and retail V2O5 flakes transactions continued to drop to about 103,000-104,000 CNY/T in cash. Affected by the psychology of buying up and not buying down, downstream purchases are extremely cautious, mainly based on rigid-demand transactions. This week, the overall transaction atmosphere of vanadium products is relatively light, and the transaction volume is small.

1. Summary of Vanadium Biddiding in August 2023

|

Company

|

Products |

Price ( CNY/T) |

Quantity ( Ton) |

Basis |

Date |

|

Shougang Changzhi |

VN16 |

167,400 |

20 |

Acceptance with tax |

31st July |

|

One steel mill in Southwest |

FeV50 |

115,500 |

99 |

Acceptance with tax |

1st Aug |

|

Shougang Tonggang |

FeV50 |

115,000 |

7 |

Cash with tax |

1st Aug |

|

One steel mill in Henan |

FeV50 |

115,000 |

20 |

Cash with tax |

1st Aug |

|

One steel mill in Shandong |

FeV50 |

117,000 (headquarters) |

50 |

Cash with tax |

1st Aug |

|

Guangxi Shenglong |

VN16 |

162,000 |

70 |

Cash with tax |

1st Aug |

|

Longteng Special Steel |

FeV50 |

117,500 |

20 |

Acceptance with tax |

1st Aug |

|

One steel mill in Fujian |

VN16 |

161,770 |

50 |

Cash with tax |

2nd Aug |

|

JISCO (headquarters) |

FeV50 |

121,000 |

30 |

Acceptance with tax |

2nd Aug |

|

One steel mill in East China |

VN16 |

164,300 |

110 |

Cash with tax |

2nd Aug |

|

One steel mill in Hebei |

FeV80 |

185,000 |

20 |

Acceptance with tax |

3rd Aug |

|

One steel mill in Hebei |

V75N16 |

163,500 |

30 |

Acceptance with tax |

3rd Aug |

|

One steel mill in Jiangsu |

VN16 |

165,000 |

60 |

Acceptance with tax |

3rd Aug |

|

Anhui Changjiang |

VN16 |

163,000 |

100 |

Acceptance with tax |

7th Aug |

|

Yunnan Chenggang |

VN16 |

161,500 |

30 |

Cash with tax |

7th Aug |

|

Shaogang |

FeV50 |

115,700 |

60 |

Acceptance with tax |

7th Aug |

|

Shaogang |

VN16 |

161,800 |

140 |

Acceptance with tax |

8th Aug |

|

EGANG |

VN16 |

161,800 |

15 |

Acceptance with tax |

8th Aug |

|

EGANG |

FeV50 |

115,700 |

20 |

Acceptance with tax |

8th Aug |

|

Shougang Changzhi |

VN16 |

162,450 |

20 |

Acceptance with tax |

9th Aug |

|

One steel mill in Central China |

FeV50 |

116,500 |

10 |

Acceptance with tax |

9th Aug |

|

One steel mill in Hunan |

FeV50 |

115,800 |

30 |

Acceptance with tax |

10th Aug |

|

One steel mill in Liaoning |

V77N16 |

164,000 |

75 |

Acceptance with tax |

10th Aug |

|

Kunming Iron & Steel (Anning Base) |

V77N16 |

158,400 |

20 |

Cash 60% +6 month bank acceptance 20% +6 month commercial acceptance 20% |

11th Aug |

|

One steel mill in Fujian |

VN16 |

158,500 |

33 |

Cash with tax |

11th Aug |

|

Hubei Jin Shenglan |

VN16 |

160,000 |

20 |

Cash with tax |

11th Aug |

|

One steel mill in Central China |

FeV50 |

116,500 |

10 |

Acceptance with tax |

14th Aug |

|

Zenith Steel Group (Changzhou) |

FeV50 |

115,000 |

20 |

Acceptance with tax |

14th Aug |

|

Minyuan Iron & Steel |

V77N16 |

157,000 |

20 |

Cash with tax |

14th Aug |

|

One steel mill in Shandong |

FeV50 |

116,500 (Rizhao) |

30 |

Acceptance with tax |

15th Aug |

|

One steel mill in Shandong |

FeV50 |

115,500 (headquarters) |

30 |

Cash with tax |

15th Aug |

|

One steel mill in Shandong |

VN16 |

157,500 |

80 |

Cash with tax |

18th Aug |

2. China vanadium market overview

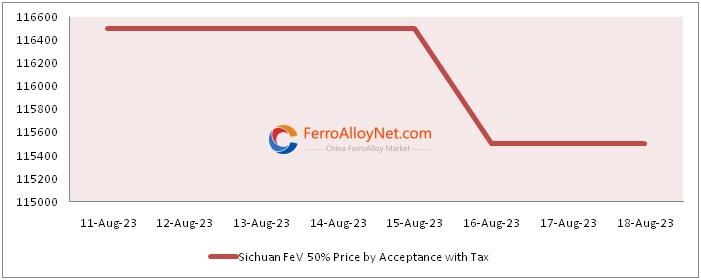

Ferro-Vanadium Market

This week, the transaction of ferrovanadium was stable and weak, and the mainstream transaction fell slightly from 116,000-117,000 CNY/T by acceptance to 115,000-116,000 CNY/T by acceptance, which was about 1,000 CNY/T lower than last week. V2O5 flakes prices fell, cost support being weak, and ferrovanadium steel recruitment were slightly lowered. However, most ferrovanadium manufacturers have little pressure to produce according to orders recently, and the high quotations in the market have decreased, but most are not lower than 115,000 CNY/T in cash. The market is dominated by traders’ shipments, while retail transactions remain light.

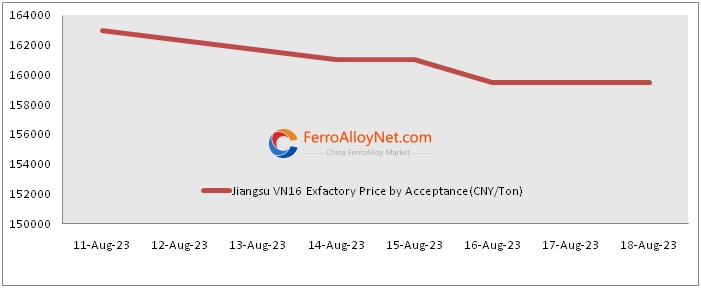

Vanadium Nitrogen Market

The transaction of vanadium nitrogen alloys dropped the most this week, from 162,000-164,000 CNY/T by acceptance to 159,000-160,000 CNY/T by acceptance, down about 3,500 CNY/T from last week. In the middle of the month, due to the small amount of steel recruitment and the drop in the price of V2O5 flakes, individual vanadium nitrogen alloy steel recruitment were under pressure to decline. Traders are making great efforts to lower the price of inquiries, but there are few actual orders. The production of vanadium nitrogen alloys is still hovering on the cost line, and most manufacturers suspend quotations until the steel recruitment is clear at the end of the month.

3. Vanadium worldwide market review

On August 16, European ferrovanadium was 31.5-33.26 USD/Kg V, equivalent to the price of ferrovanadium50 about 113,400-119,900 CNY/Ton; European vanadium pentoxide was 7.7-8.76 USD/Lb, equivalent to vanadium pentoxide98% about 119,800-136,200 CNY/Ton; U.S. ferrovanadium was 15.75-16.5 USD/Lb V, equivalent to the price of ferrovanadium50 about 124,900-130,800 CNY/Ton.

4. Forecast on next week

Affected by the news of steel mills’ production restriction in some areas, as well as the lack of recruitment of alloy steel and thin transactions in the middle of the month, the pessimism of the vanadium market has increased slightly. However, considering the high cost of stockpiling for most V2O5 flakes retail investors in the early stage, it is expected that the downside of raw materials will be limited for the time being. The demand is weak, but the bottom of the vanadium alloy is still supported. The market may still fluctuate within a narrow range next week, so pay attention to the progress of steel recruiting at the end of the month.