www.ferroalloynet.com: Vanadium market is weak with prices declining by 750-2000 CNY/T this week. At the beginning of the week, the steel bidding for vanadium nitride alloy took the lead in falling due to the contradiction between the oversupply of alloys and demand and the manufacturers’ selling intentions increased. Affected by the price drop in the alloy market, inquiries for downstream raw materials decreased and quotations from V2O5 flake holders gradually loosened, which put the transaction prices returned to the level at the beginning of the month. To sum up, the demand support is insufficient, vanadium pentoxide flake are over capacitated and the upstream is still reluctant to sell, the vanadium market fluctuates within a narrow range. And it may not have any improvement yet next week as the demands don’t have any improvement.

1. Summary of Vanadium Biddiding in August 2023

|

Company

|

Products |

Price ( CNY/T) |

Quantity ( Ton) |

Basis |

Date |

|

Shougang Changzhi |

VN16 |

167,400 |

20 |

Acceptance with tax |

31st July |

|

One steel mill in Southwest |

FeV50 |

115,500 |

99 |

Acceptance with tax |

1st Aug |

|

Shougang Tonggang |

FeV50 |

115,000 |

7 |

Cash with tax |

1st Aug |

|

One steel mill in Henan |

FeV50 |

115,000 |

20 |

Cash with tax |

1st Aug |

|

One steel mill in Shandong |

FeV50 |

117,000 (headquarters) |

50 |

Cash with tax |

1st Aug |

|

Guangxi Shenglong |

VN16 |

162,000 |

70 |

Cash with tax |

1st Aug |

|

Longteng Special Steel |

FeV50 |

117,500 |

20 |

Acceptance with tax |

1st Aug |

|

One steel mill in Fujian |

VN16 |

161,770 |

50 |

Cash with tax |

2nd Aug |

|

JISCO (headquarters) |

FeV50 |

121,000 |

30 |

Acceptance with tax |

2nd Aug |

|

One steel mill in East China |

VN16 |

164,300 |

110 |

Cash with tax |

2nd Aug |

|

One steel mill in Hebei |

FeV80 |

185,000 |

20 |

Acceptance with tax |

3rd Aug |

|

One steel mill in Hebei |

V75N16 |

163,500 |

30 |

Acceptance with tax |

3rd Aug |

|

One steel mill in Jiangsu |

VN16 |

165,000 |

60 |

Acceptance with tax |

3rd Aug |

|

Anhui Changjiang |

VN16 |

163,000 |

100 |

Acceptance with tax |

7th Aug |

|

Yunnan Chenggang |

VN16 |

161,500 |

30 |

Cash with tax |

7th Aug |

|

Shaogang

|

FeV50 |

115,700 |

60 |

Acceptance with tax |

7th Aug |

|

Shaogang |

VN16 |

161,800 |

140 |

Acceptance with tax |

8th Aug |

|

EGANG |

VN16 |

161,800 |

15 |

Acceptance with tax |

8th Aug |

|

EGANG |

FeV50 |

115,700 |

20 |

Acceptance with tax |

8th Aug |

|

Shougang Changzhi |

VN16 |

162,450 |

20 |

Acceptance with tax |

9th Aug |

|

One steel mill in Central China |

FeV50 |

116,500 |

10 |

Acceptance with tax |

9th Aug |

|

One steel mill in Hunan |

FeV50 |

115,800 |

30 |

Acceptance with tax |

10th Aug |

|

One steel mill in Liaoning |

V77N16 |

164,000 |

75 |

Acceptance with tax |

10th Aug |

2. China vanadium market overview

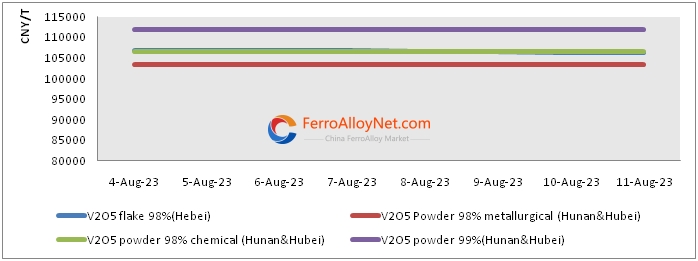

V2O5 Market

The deal price for V2O5 flake falls slightly this week. Affected by the declining market price from alloy and the active sales intention from suppliers, the overall quotation had dropped a bit. Till Friday, the quotation for V2O5 flake offered at 106,000 CNY/T by cash with tax and clinched at 105,500 CNY/T by cash with tax.

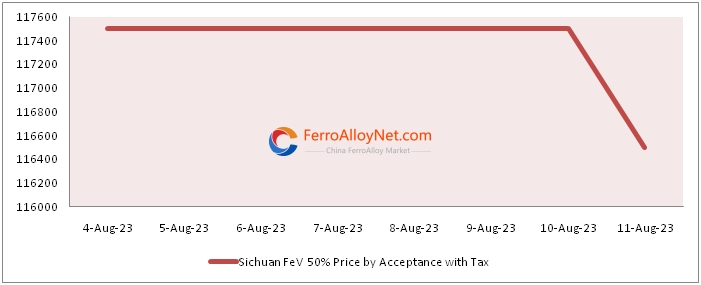

Ferro-Vanadium Market

Impacted by the soft bidding price from steel mills, the ferrovanadium market prices also edge down this week. Currently the steel recruitment in the market is rare. Besides, V2O5 flake market prices also dropped a bit. Both costs and demands had pulled down the ferrovanadium prices. And some ferrovanadium traders also preferred to wait and see rather than making offer.

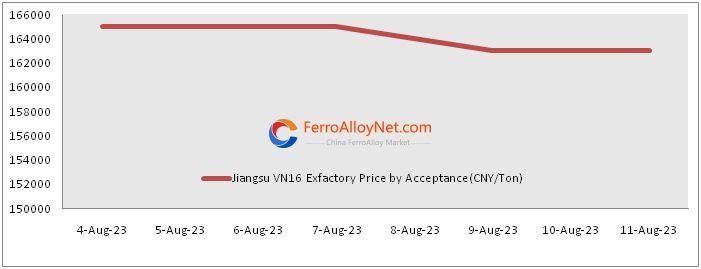

Vanadium Nitrogen Market

This week, the vanadium nitride alloy market weakens again with price falling by 2000 CNY/T. Recently, the operating rate of vanadium nitride alloy manufacturers has increased slightly, and most manufacturers are producing normally. Faced with steel mills’ bidding, manufacturers are active to sell which puts the contradiction between supply and demand to have become prominent. Some steel mills also are active to squeeze the purchasing prices especially for some medium and large scale steels. As of Friday, retail manufacturers and traders quoted 160,000 CNY/T by cash with rare deals.

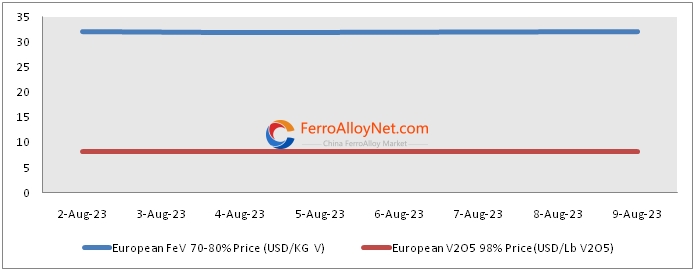

3. Vanadium worldwide market review

On August 9, European ferrovanadium was 31.6 (up 0.5)-32.51 (down 0.2) USD/Kg V, equivalent to the price of ferrovanadium50 about 113,100-116,400 CNY/Ton; European vanadium pentoxide was 7.7-8.76 USD/Lb, equivalent to vanadium pentoxide98% about 119,100-135,500 CNY/Ton; U.S. ferrovanadium was 15.75-16.5 USD/Lb V, equivalent to the price of ferrovanadium50 about 124,300-130,200 CNY/Ton.

4. Forecast on next week

FerroAlloyNet is forecasted a downward market for vanadium next week as the steel bidding in the middle of month is not active and some V2O5 flake traders are active to make offer. The long term order price for V2O5 flake from large scale producers in August deal at .106,500 CNY/T by cash with tax, which is a high costs for downstream buyers. Under this condition, the overall decline for vanadium will not in high level.