Australian Vanadium Ltd (ASX:AVL) has received firm commitments from existing and new institutional, professional and sophisticated investors to raise $20 million before costs in an upcoming placement.

In conjunction with the placement, the company has launched a share purchase plan (SPP) to give existing eligible shareholders the opportunity to subscribe for new shares to raise up to an additional $7.5 million (before costs).

The placement enables investors to subscribe for approximately 425.5 million new fully paid ordinary shares at a price of $0.047 each.

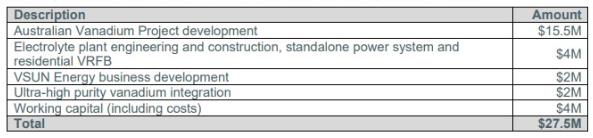

Funds raised under the placement and SPP will be used to finance ongoing work at AVL’s Australian Vanadium Project and to develop key downstream markets ahead of finalising debt financing and a final investment decision, with funds specifically applied towards:

Managing director Vincent Algar said of the raise: “We are extremely pleased with the overwhelming support we have received for this capital raising. The capital raising saw new institutional and sophisticated investors join the register, as well as receiving strong participation from AVL’s existing shareholders.

“We are also pleased to provide an opportunity for our valued retail investors to participate in the capital raising through the offer of the SPP. The funds raised through the placement and the SPP will ensure that the company remains well funded while we implement the next phases of the development program for the Australian Vanadium Project.”

Placement details

AVL has undertaken a non-underwritten single tranche placement of approximately 425.5 million new shares to raise $20 million (before costs). New shares will be issued at an offer price of $0.047 per share, which represents a:

17.5% discount to the last closing price of AVL shares on ASX of $0.057 on 17 May 2022 (being the last day on which AVL shares traded before this announcement);

17.4% discount to the five-day volume weighted average price (VWAP); and

22.2% discount to the 15-day VWAP.

SPP details

The non-underwritten SPP aims to raise up to an additional $7.5 million (before costs), giving shareholders the opportunity to apply for new shares at the same offer price as the placement.

Eligible shareholders will be offered the opportunity under the SPP to apply for up to $30,000 worth of new shares (subject to a scale back policy which will be set out in the SPP offer booklet), irrespective of the size of their shareholding, and without incurring brokerage or transaction costs.

New shares issued under the SPP will rank equally with AVL’s existing shares on issue.

www.ferroalloynet.com