www.ferroalloynet.com: This week, the domestic vanadium market operates steadily and weakly, and the demands for vanadium from steel mills in this high temperature and rainy season are insufficient. In addition, it is just in the middle of the month, so the alloy market inquiry is particularly rare. Under the situation of strong supply and weak demand, vanadium price maintain stability with slightly falling. Vanadium nitrogen alloy manufacturers and traders make concessions to sell at the price of 192,000-193,000 CNY/T by cash, and ferrovanadium 50# offers at 142,000-143,000 CNY/T by cash, but the transaction is still not easy. Vanadium pentoxide flake is relatively strong, the cost of vanadium nitrogen alloy plant is much higher than the selling prices, which put companies to reduce or suspend production for thermal insulation. Some manufacturers just need to purchase according to the real demand, and the retail prices are concluding at 130500-130500 CNY/T by cash, which is basically the same as that of large factories. The quotation intention of more vanadium plants is not high. They prefer to wait and see the pricing from large vanadium plants and the new round of steel bidding next week.

1. Summary of Vanadium Biddiding in July

|

Company

|

Products |

Price ( CNY/Ton) |

Quantity ( Ton) |

Basis |

Date |

|

Shougang Changzhi |

VN16 |

196,300 |

20 |

Acceptance with tax (cash before delivery) |

July 1st |

|

Benxi Steel |

VN16 |

198,500 |

60 |

Acceptance with tax |

July 1st |

|

One steel in Liaoning |

VN16 |

198,500 |

60 |

Acceptance with tax |

July 1st |

|

One steel mill in Jiangsu |

VN16 |

199,300 |

15 |

Acceptance with tax (Including the tender fee) |

July 1st |

|

VN16 |

200,000 |

45 |

Acceptance with tax (Including the tender fee) |

July 1st |

|

|

FV50 |

143,000 |

30 |

Acceptance with tax (Including the tender fee) |

July 1st |

|

|

One Steel in Fujian |

VN16 |

195,000 |

50 |

Cash with tax |

July 3rd |

|

One Steel in Shandong

|

FeV50 |

146,900-150,000 | 65 | Acceptance with tax |

July 5th |

|

Shougang Changzhi |

VN16 |

196,300 |

20 |

Acceptance with tax |

July 6th |

|

Anhui Changjiang Steel |

VN16 |

200,500 |

170 |

Acceptance with tax |

July 7th |

|

One Steel Mill in East China |

VN16 |

202,400 |

90 |

Acceptance with tax |

July 7th |

|

LY Steel

|

FeV50 |

142,000 |

10 |

Acceptance with tax |

July 8th |

|

LY Steel

|

V75N16 |

195,000 |

30 |

Acceptance with tax |

July 8th |

|

One Steel mill in Shandong

|

VN16 |

198,000-200,000 |

190 |

Acceptance with tax |

July 8th |

|

One Steel mill in Hebei

|

VN16 |

200,800 |

60 |

Acceptance with tax |

July 14th |

|

Echeng Steel

|

VN16 |

197,500 |

80 |

Acceptance with tax |

July 15th |

2. China vanadium market overview

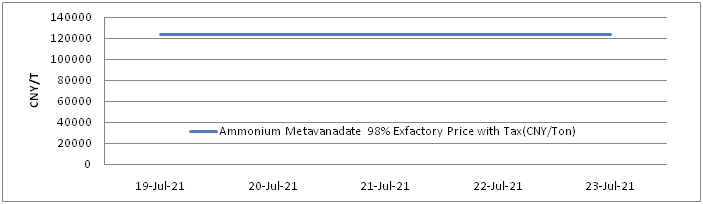

Ammonium metavanadate market

Ammonium metavanadate market keeps steady with the demands from VN alloy and chemical industry are weak which makes the deals to be rare. However, many ammonium metavanadate producers are active to make offer and the prices for chemical AMV 98% are 126,000 CNY/T by cash. But the most downstream buyers don’t have any interest to buy it with this high price but prefer to accept the price of 123,000-124,000 CNY/T by cash.

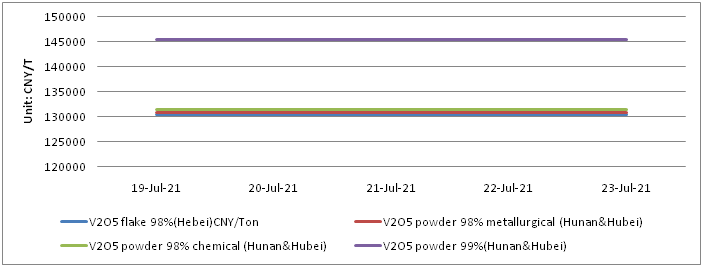

V2O5 Market

This week, the V2O5 flake market stays dilemma with the high quotation but low buying prices. Some big plants or traders conclude the deals at 130,000-130,500 CNY/T by cash. This week Jianlong Group starts to make the contract which concludes the long-term order prices at 132,000 CNY/T by acceptance. Some small producers are encouraged to offer the price to 131,000 CNY/T by acceptance but the demands are fewer and they buyers prefer the price at 130,000 CNY/T by acceptance. Traders stay calm at present with waiting-and seeing the market.

Ferro-Vanadium Market

The ferrovanadium market is stable this week with few deals. The first round of steel bidding for ferrovanadium doesn’t start yet and the overall offers stay steady from producers. And traders are also cautious to buy at present. The current few deal prices are concluding at 142,000-143,000 CNY/T by cash.

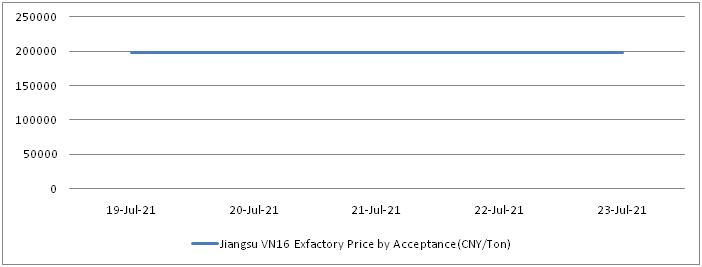

Vanadium Nitrogen Market

This week, vanadium nitrogen alloys market is a bit slow with weak demands and few companies even reduce the quotation to 192,000-193,000 CNY/T by cash. However, the deals are lower than this price and some producers even suspend to making offer as they think it is nonsense to reduce the prices. They prefer to wait the guide price from big plants and steel bidding. In general, the slow demands make the selling price is lower than the cost which makes the companies to reduce the production or suspend production.

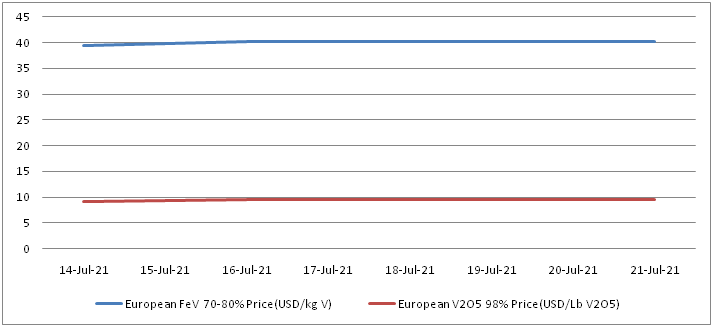

3. Vanadium worldwide market review

On 21 July 2021, the price of ferrovanadium in Europe drops to 39.7-40.75 USD/kg V, convert into 50# ferrovanadium RMB price was 128,400-131,800 CNY/Ton. The price of European V2O5 was 9.45-9.75 USD/Lb V2O5, convert into V2O5 98% RMB price was 132,100-136,200 CNY/Ton. The price of ferrovanadium in United States was 17.2-17.5 USD/Lb V, convert into 50# ferrovanadium RMB price was 122,600-124,800 CNY/Ton.

4. Forecast on next week

Next week, the long-term order price from large vanadium plants in August is going to conclude, and a new round of vanadium alloy bidding is gradually started. With the support of vanadium cost, the bidding price of mainstream steel mill may stay stable. The VN alloy factory quotes may face high cost and low selling price, the production enthusiasm is naturally not high. It is better to suspend production for thermal insulation. However, it is slightly weak to promote the rise of vanadium price. After all, the demand of steel mills is relatively weak due to the seasonal impact in August.

www.ferroalloynet.com