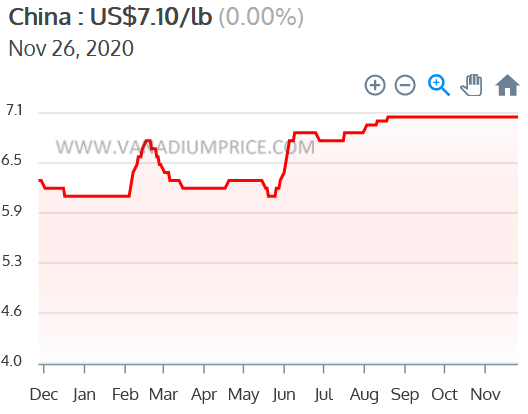

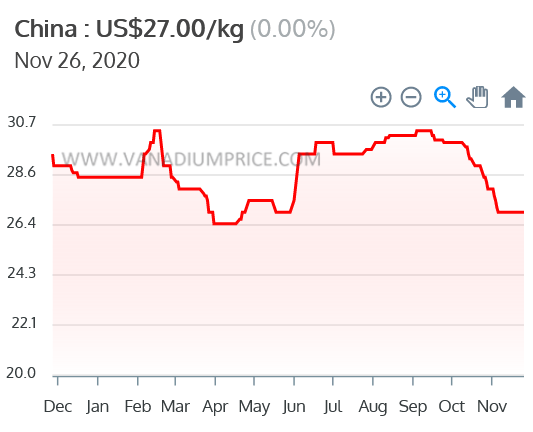

China vanadium spot prices were not updated (?flat) in November.

Vanadium market news – Biden plans to eliminate carbon emissions from the US electric sector by 2035. The case for vanadium storage batteries is picking up speed.

Vanadium company news – Shell & AMG recycling sign agreement with Shandong Yulong to assess building a spent residue upgrading catalyst recycling facility. Bushveld & Largo Resources achieve records.

Neometals pilot plant achieves vanadium recoveries exceeding 75% and 99.5% V2O5 purity. Vanadium Resources releases a strong Limited Scoping Study. VanadiumCorp reports a large Lac Dore Mineral Resource Estimate.

I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Welcome to Vanadium miners news. November saw a new US President-elect Joe Biden who aims to make the US energy carbon free by 2035. This is potentially a huge boost for the energy storage sector, which includes vanadium redox flow batteries.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

China Vanadium Pentoxide [V2O5] Flake 98% 1 year chart – Price = USD 7.10/lb (? if price has been updated)

China Ferrovanadium [FeV] 80% Price = USD 27.00

Source: Vanadiumprice.com

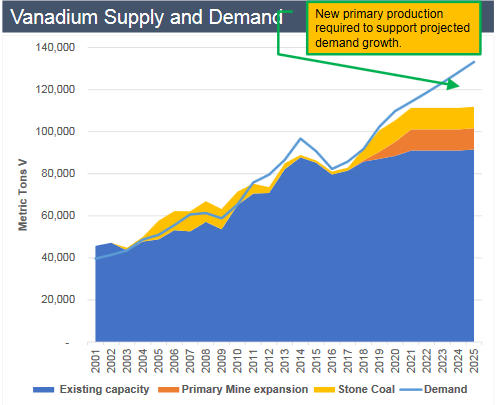

Vanadium demand versus supply

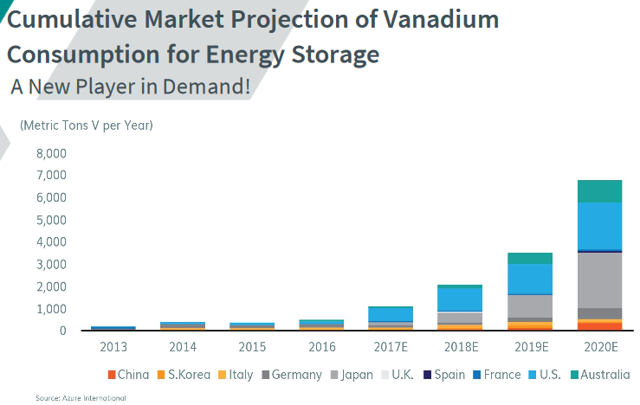

The charts below show energy storage to be a new source of vanadium demand, and overall demand looks likely to grow very strongly to 2025.

Vanadium total demand forecast to outstrip supply 2020-2025

Source: Technology Metals Australia investor presentation & TTP Squared

Roskill estimates that vanadium demand “for VRFB markets” could rise to 31,000 tons by 2025, amounting to a rise of 3,100% in a decade.

Source: Australian Vanadium presentation

In 2017 Robert Friedland stated:

We think there’s a revolution coming in vanadium redox flow batteries….”

Vanadium market news

An article I missed from October 19 reported:

The case for vanadium storage batteries is picking up speed. Some of California’s problems, fires aside, may stem from the issue of storage. California needs to overhaul the way electricity is stored and many in the state are waking up to this……California’s quest for better energy storage is playing into the hands of companies that have been pursuing specific large scale, industrial energy storage solutions based on vanadium flow battery technology. Unlike smaller lithium-ion batteries, these are designed to store power from clean energy sources on a massive scale. mong those who could benefit is Invinity Energy Systems (LSE:IES), the vanadium flow battery manufacturer, which has been awarded funding for four projects from the California Energy Commission.

On November 12 Energy Storage News reported:

Flow battery to be paired with solar at South African vanadium mine’s microgrid system. A solar-plus-storage microgrid being deployed at an alloys mine in South Africa will feature a vanadium flow battery energy storage system, using locally sourced vanadium electrolyte.

On November 19 Solar World reported:

Vanadium flow battery to be installed at Native American-run fire station in Southern California. GRID Alternatives recently installed a vanadium flow battery (VFB) supplied by Invinity Energy Systems at a fire station run by the Soboba Band of Luiseño Indians in Southern California. The 500-kWh battery is part of a $1.7 million project including 500 kW of on-site solar that will ensure uninterrupted power and significantly improve energy resiliency for the Soboba Fire Department.

Invinity Energy Systems VRB

On November 23 BloombergNEF reported:

How PV-plus-Storage will compete with gas generation in the U.S. This report by BloombergNEF shows how the combination of solar power plants and battery storage can be a clean, economic alternative to an increasingly large share of U.S. gas generation. Its analysis provides valuable insight on a techno-economic trend that lies at the heart of the future of the U.S. power sector and its decarbonization. It comes at a time where President-elect Joe Biden is preparing proposals that aim to put the U.S. on a pathway toward a net-zero power system by 2035.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTC:OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

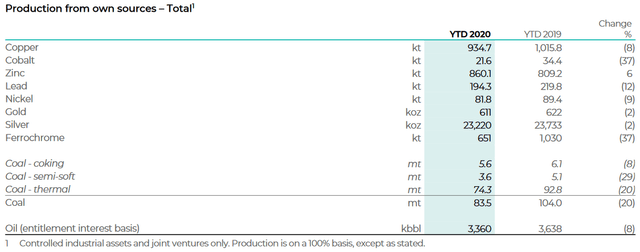

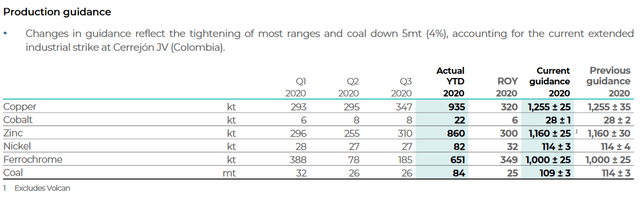

On October 30, Glencore announced:

Third quarter 2020 production report. The generally strong sequential quarterly production performance…….in large part, reflects reversal of the various short-term Covid-19 related shutdowns in Q2, as mandated by several national/local governments.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

On October 26, AMG Advanced Metallurgical Group NV announced:

Shell & AMG recycling B.V. sign agreement with Shandong Yulong Petrochemical Co., Ltd to assess building a spent residue upgrading catalyst recycling facility…..

On October 28, AMG Advanced Metallurgical Group NV announced: “AMG Advanced Metallurgical Group N.V. reports third quarter 2020 results.” Highlights include:

Strategic Highlights

- “The Company will change its organizational structure effective January 1, 2021. This change will result in three reporting segments: AMG Clean Energy Materials (“CEM”), AMG Critical Materials Technologies (“CMT”) and AMG Critical Minerals (“CMI”).

- The construction of AMG’s second ferrovanadium plant in Zanesville, Ohio is proceeding as planned. As of September 30, 2020, AMG has committed $184 million in construction and engineering contracts for the project.

- AMG continued basic engineering for its lithium hydroxide refinery project in Sachsen-Anhalt, Germany and a final investment decision is presently expected in early 2021…..”

Financial Highlights

- “AMG Engineering’s order intake in the first 9 months of 2020 was $177 million, a 5% increase from $169 million in the first 9 months of 2019.

- AMG’s liquidity as of September 30, 2020, was $376 million, with $206 million of unrestricted cash and $170 million of revolving credit availability.

- EBITDA was $14.1 million in the third quarter of 2020, a 42% decrease from $24.4 million in the third quarter of 2019. COVID-19 had a negative $23 million impact in the third quarter of 2020 which is explained in more detail on page 3.

- AMG reduced SG&A by 16% in the third quarter of 2020 to $29.6 million, compared to $35.1 million in the third quarter of 2019, due to lower personnel costs and ongoing cost reduction initiatives.

- Cash from operating activities on a year to date basis was $8.3 million, an increase of $17.2 million over the same period in 2019.”

On November 19, AMG Advanced Metallurgical Group NV announced:

AMG Advanced Metallurgical Group N.V. announces investment in solid state battery material pilot plant to complement its state-of-the-art battery materials laboratory located in Frankfurt, Germany.

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On November 9, Bushveld Minerals Limited announced:

Successful raise of US$35 million convertible loan note instrument with Orion Mine Finance……

On November 9, Bushveld Minerals Limited announced: “Vametco mini-grid update.” Highlights include:

- “Receipt of environmental authorisation, following the submission of the Environmental Basic Assessment (“BA”), from the Department of Mineral Resources and Energy (“DMRE”) of South Africa, for the construction of the project……

- A memorandum of understanding has been signed with Thebe Investment Corporation (“Thebe”), a South African investment management company, as a strategic equity partner in the development and funding of the hybrid mini-grid project. Thebe will be active in the development of the project going forward including assisting the Company in finalising the terms of the external debt funding.

- In addition to the above, Bushveld had previously announced other key milestones in the project, including signing of a power purchase agreement (“PPA”) with Vametco and obtaining a term-sheet for long-term debt funding of the hybrid mini-grid project.”

On November 24, Bushveld Minerals Limited announced: “Q3 and 9 months 2020 operational update.” Highlights include:

Bushveld Vanadium

- “Group production for Q3 2020 of 1,019 mtV was 31 per cent higher than Q2 2020 (Q2 2020: 778 mtV) due to the lifting of the nationwide lockdown, which occurred in Q2 2020.

- Group production for 9M 2020 of 2,667 mtV was 37 per cent higher than 9M 2019 (9M 2019: 1,953 mtV), as a result of the inclusion of the Vanchem processing assets for the full nine month period.

- Group sales for 9M 2020 of 2,987 mtV was 74 per cent higher than 9M 2019 (9M 2019: 1,719 mtV), as a result of the inclusion of sales from Vanchem.

- Severe weather conditions at the beginning of November 2020 resulted in an unexpected longer than normal power outage at Vametco, impacting the refinery section.

- Despite this incident, and assuming there are no further stoppages, the Group still expects to meet the lower end of its full year production guidance range of between 3,660 mtV and 3,950 mtV………..”

Vanadium and VRFB Markets

- “…..The increased infrastructure spending in China has resulted in higher steel production, supporting vanadium demand, with China been a net vanadium importer during the months of July, August and September 2020.

- The weak demand in Europe as a result of further lockdown measures being introduced, as well as constrained demand in the United States, is expected to continue until the end of 2020.

- However, we expect increased deployment of VRFBs demand, as governments focus on accelerating the energy transition to a low-carbon energy future, which will increase vanadium demand…..”

You can view the latest investor presentation here.

Largo Resources [TSX:LGO] [GR:LR81] (OTCQX:LGORF)

Largo Resources is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil.

On November 12, Largo Resources announced: “Largo Resources announces solid third quarter 2020 results highlighted by its successful sales strategy implementation and continued low-cost operations.” Highlights include:

Q3 2020 Highlights

- “Solid financial position: Cash at September 30, 2020 totaled $74.9 million

- Revenues of $27.5 million, an increase of 14% over Q3 2019

- Revenues per pound sold of $5.37, a 34% increase over Q3 2019

- Net income of $2.6 million vs. a net loss of $6.0 million in Q3 2019

- Total sales exceeded production levels in August and September 2020 for the first time since commercial independence, highlighting successful implementation of the Company’s strategy

- Cash provided (used) before working capital items of $4.8 million vs. cash used in Q3 2019 of $3.8 million

- Record production of 3,092 tonnes (6.8 million pounds) of V2O5, an increase of 5.0% over Q3 2019

- Record global V2O5 recovery rate of 84.2% in Q3 2020, an increase of 8.0% over Q3 2019

- Continued low-cost operations: Cash operating costs excluding royalties of $3.14 per lb of V2O5, compared with $3.02 per lb in Q3 2019; Total cash costs were $3.69 per lb in Q3 2020……..”

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio”, as well as being a recent vanadium producer.

On October 30, Energy Fuels announced: “Energy Fuels announces q3-2020 results; Debt-free with strong working capital; Advancement of uranium & rare earths; Webcast on November 3, 2020.”

- Working capital included $28.1 million in cash and marketable securities, plus $25.6 million of concentrate inventory and work in progress, including 663,300 pounds of uranium concentrates valued on our balance sheet at $23.72 per pound and 1,672,000 pounds of vanadium valued on our balance sheet at $5.11 per pound, both in the form of immediately marketable product……..

- On September 21, 2020, the Company and a team from Penn State University were selected by the U.S. Department of Energy (“DOE”) to develop a design for the production of a rare earth element (“REE”) concentrate from coal-based resources. The Company believes the REEs contained in these coal-based resources are similar to the REEs contained in other ores the Company is evaluating in its REE program.”

Ferro Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR state: “The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

No vanadium related news for the month.

Vanadium developers

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

On November 2, Western Uranium & Vanadium Corp. announced:

Western Uranium & Vanadium Corp. corporate update. With respect to market conditions, the Company continues to closely follow a number of potential key catalysts driving improvements in the vanadium and uranium markets including: Vanadium Section 232: United States Department of Commerce (“DOC”) is reviewing a petition by industry participants that requests a 40% tariff on vanadium imports from all sources and the establishment of a stockpiling program. Separate tariff rate quotas were requested for refined vanadium products. Western has submitted survey data and continues to support this investigation and remedies that level the playing field for U.S. domestic producers versus foreign state sponsored competitors.

Investors can read the latest company presentation here.

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On October 30, Neometals announced: “Quarterly activities report for the quarter ended 30 September 2020.” Highlights include:

Corporate

- “Cash A$76.6 million, receivables and investments of A$7.3 million and no debt.

- Core development projects advancing through evaluation stages with all projects funded through to final investment decisions.”

Vanadium Recovery Project

- “Successful completion of continuous mini-pilot plant with final assay results and test work report pending.

- Successful completion of grade confirmation/metallurgical sample drill program on stockpiles at SSAB Lulea steel mill.

- Identification of plant sites for Prefeasibility Study and tender process materially complete, awaiting final test work report before final award, due for completion by mid CY 2021.”

Barrambie Titanium and Vanadium Project

- “Identification of preferred flowsheet / development structure which produces titanium-rich gravity concentrate on site for downstream processing in China into chloride ilmenite and vanadium-rich magnetite.

- Strong product evaluation and marketing feedback from potential Chinese offtakers. Mining and on-site concentration studies have commenced with contractors for potential development on a build-own-operate basis…..”

On November 4, Neometals announced: “Successful vanadium recovery mini-pilot and commencement of PFS.” Highlights include:

- “Successful demonstration of Neometals’ proprietary vanadium recovery flowsheet in continuous mini-pilot test work campaign.

- Exceptional product purity of greater than 99.5% V2O5.

- Vanadium recoveries exceeding 75%.

- Leach residence times reduced by 50% from Scoping Study design – positive implications for capital costs.

- Preliminary feasibility study (“PFS”) manager appointed, targeting completion in June 2021.”

You can view the latest investor presentation here.

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia.

On November 2, Australian Vanadium announced: “The Australian Vanadium Project to produce high purity vanadium pentoxide.” Highlights include:

- “High purity 99.4% vanadium pentoxide [V2O5] produced from representative leach liquor.

- The vanadium flake product from the Australian Vanadium Project is expected to be of outstanding quality, comparable to high purity products from existing global producers.

- Testing has included APV and AMV production routes, allowing optionality in the BFS to simplify the refinery circuit and potentially lower both capital and operating costs.

- Testwork demonstrates ability to produce high purity V2O5 at scale.”

On November 25, Australian Vanadium announced: “Green hydrogen offtake MOU with ATCO.”

Catalysts include:

- Early 2020 – Possible further off-take and/or JV partner announcements.

- 2020 – DFS due.

You can view the latest investor presentation here, or read “Australian Vanadium Managing Director Vincent Algar Talks With Matt Bohlsen Of Trend Investing.”

Technology Metals Australia [ASX:TMT]

The Company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

On October 26, Technology Metals Australia announced:

Premium iron–vanadium concentrate produced LoI with Sinosteel Australia for life of mine offtake and EPC.

On October 30, Technology Metals Australia announced: “Quarterly activities report & appendix 5b for the quarter ended 30 September 2020.” Highlights include:

- “TMT identifies opportunity to produce a high grade, high purity iron-vanadium concentrate containing up to 66.3% Fe and 1.73% V2O5 from the Yarrabubba Iron-Vanadium Project. Premium product with very low levels of deleterious elements, indicates scope to produce a Platts 65 Fe product……

- Emergence of Yarrabubba is a major breakthrough for the Company, potentially delivering a low entry cost project that is complimentary to, and expected to reduce funding and implementation risk for, the Gabanintha Vanadium Project.

- Maiden Probable Ore Reserve estimate of 9.4Mt at 45.3% Fe and 0.97% V2O5 Defined for the Yarrabubba Iron-Vanadium Project.

- The two Project Mining Lease granted for an initial 21-year period.

- Workstreams to support the preparation of the GVP Environmental Review Document on track for the targeted submission in the first quarter of calendar year 2021.

- MOU executed with APA Group to investigate the provision of gas transportation services along a new gas pipeline to be developed by APA from the south to supply gas to the GVP.

- Offtake MOU with Fengyuan extended until the end of December 2020 to enable the parties to fully evaluate the project development impact of the emerging Yarrabubba Project.

- Continuing to work with NAIF and other potential partners in line with the Company’s strategy to secure project development funding.

- As at the end of September 2020 the Company had cash of $2.2 million….”

On November 11, Technology Metals Australia announced: “Representative testwork confirms premium Yarrabubba product.”

Catalysts include:

- 2020 – Possible further off-take announcements. Possible funding or equity partner announcements.

You can view the latest investor presentation here, or read “Technology Metals Australia Executive Director Ian Prentice Talks With Matt Bohlsen Of Trend Investing.”

TNG Ltd [ASX:TNG] [GR:HJI] (OTCPK:TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product.

On November 3, TNG Ltd announced: “TNG to establish Vanadium Redox Flow Battery business.” Highlights include:

- “TNG has established a Vanadium Redox Flow Battery (“VRFB”) business unit as part of the vertical integration strategy for its flagship Mount Peake Vanadium-Titanium-Iron Project, further expanding its strategic footprint in the green energy sector…..

- TNG has previously produced high-purity vanadium electrolyte from vanadium pentoxide produced in pilot scale testwork for Mount Peake.

- The VRFB business unit will be owned by TNG Energy, the Company’s green energy-focused subsidiary company…..”

On November 5, TNG Ltd announced:

TNG submits revised mining management plan for the Mount Peake mine site. Submission of revised MMP follows response to all key matters raised by the Northern Territory Government and marks another important permitting milestone

On November 24, TNG Ltd announced:

TNG appoints key renewable energy advisors to advance Vanadium Redox Flow Battery business.

You can view the latest investor video presentations here.

Aura Energy [ASX:AEE] [GR:VU1] (OTC:AUEEF)

Aura Energy is an Australian-based minerals company that 100% owns polymetallic and uranium projects with large resources in Sweden (Häggån Project) and Mauritania (Tiris project). Aura’s focus is on the Häggån Project, located in Sweden’s Alum Shale Province, one of the largest depositories of vanadium in the world.

On October 30, Aura Energy announced: “Aura signs funding facility.”

On November 5, Aura Energy announced: “Annual report 2020 year 30 June 2020.”

On November 6, Aura Energy announced:

September quarterly report 31st October 2020. The Company held its third s.249D requisition for a shareholder’s over a period of 8 months where various groups have attempted to install individuals based in Hong Kong, Indonesia and Panama; however in the latest meeting all were again defeated…….

You can view the latest investor presentation here.

Silver Elephant Mining Corp. [TSX:ELEF] (OTCQX:SILEF) (100% owned subsidiary Nevada Vanadium LLC)

Silver Elephant Mining Corp. is a Canadian public company listed on the Toronto Stock Exchange. The Company’s objective is to advance the Gibellini Black Shale primary vanadium project and the Bisoni Vanadium Project. Gibellini aims to be the first active primary vanadium mine in North America. They also have huge silver assets in Bolivia.

On November 17, Silver Elephant Mining Corp. announced:

Silver Elephant announces filing of technical report for Pulacayo Project and final short-form prospectus for previously announced $8.0 million bought deal offering.

On November 24, Silver Elephant Mining Corp. announced:

Silver Elephant announces closing of C$9.2 million bought deal public offering, including full exercise of the over-allotment option.

On November 25 Silver Elephant reported:

Silver Elephant: First El Triunfo Drill Hole Intercepts 48.9 Meter Mineralization Grading 1.45 g/t Gold Equivalent (0.42 g/t Gold, 35.5 g/t Silver, 1.17% Zinc, and 0.83% Lead) within 98.9 Meters Grading 1.04 g/t AuEq.

You can view the latest investor presentation.

Vanadium Resources Limited [ASX:VR8]

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

On October 30, Vanadium Resources Limited announced: “Activities report –September quarter 2020.” Highlights include:

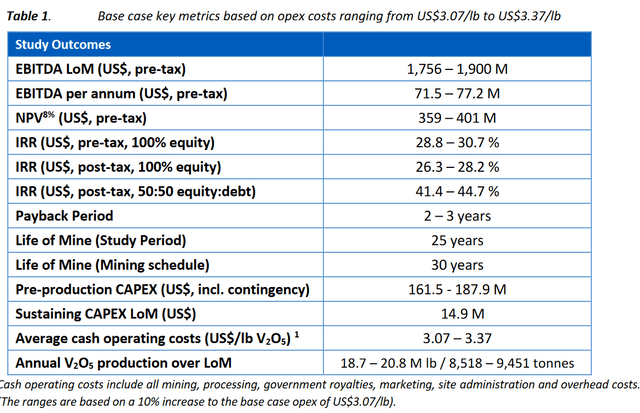

- “Scoping Study results confirm viability of production of vanadium pentoxide from the Steelpoortdrift Vanadium Project.

- Scoping Study indicates the project exhibits globally competitive opex and capex metrics and confirms that production of vanadium pentoxide utilising conventional salt roast-leach processing methods is technically and financially viable.

- Financial modelling presents significant potential values and robust returns with attractive payback and a resilience to low price environments.

- Low operating and capital expenditures ascribable to the high grade nature of the vanadium mineralisation, along with access to regional infrastructure and local experience in production of vanadium products.

- Low operating costs forecast resulting in the project retaining strong margins should prices move to the downside.

- Including cash reserves as at 30 September 2020, the Company has approx. A$1,050,000 (before costs) of financial means available to it to advance its world class Steelpoortdrift vanadium project.

- Marketing mandate (non-exclusive) granted to Pelagic Resources Group, a global commodity merchant that holds customer relationships with Chinese state-owned enterprises, global asset allocators and large international commodity merchants.

- Stable trade in vanadium market continues with demand increasing as is traditional at this time of year, long term demand for vanadium and vanadium products remains strong.”

Scoping Study highlights

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

On October 26, King River Resources announced:

Activities report – September quarter 2020. Further PFS testwork and studies undertaken, including refinement and optimisation of the KRR HPA process and updating the Mining and Marketing studies. Drilling at the Tennant Creek Gold-Copper Project commenced during the September quarter, initially at the Lone Star Trend and Commitment IOCG targets. A Placement and Security Purchase Plan raised $9,861,240 with current cash position of $8,535,975. These funds are being applied to the ongoing HPA development testwork and studies in order to complete a Prefeasibility Study, for further exploration on the Mt Remarkable and Tennant Creek gold project areas, and for working capital.

You can view the latest investor presentation here.

VanadiumCorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:APAFF)

VanadiumCorp Resources Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

On October 29 VanadiumCorp announced:

VanadiumCorp reports Lac Dore Mineral Resource Estimate (MRE)….Lac Doré Mineral Resource Estimate (MRE): 214.93 MILLION Tonnes Grading 24.6% Magnetite and 1.3% v2o5 in Magnetite Concentrate (equivalent to 1.49 Billion Pounds of Vanadium pentoxide contained) at Lac Doré, Québec. Additional Inferred Mineral Resources of 86.91 Million Tonnes Grading 25.9% Magnetite and 1.2% v2o5 in Magnetite Concentrate (Equivalent to 0.61 Billion Pounds of Vanadium Pentoxide Contained)…

On November 13, VanadiumCorp announced:

VanadiumCorp Resource Inc. acquires all patent rights and the entire VanadiumCorp-Electrochem Process Technology (“VEPT”) intellectual property portfolio.

You can view the latest investor presentation here.

First Vanadium Corp. [TSXV:FVAN] (FVANF) (formerly Cornerstone Metals Inc.)

Cornerstone’s Carlin Vanadium project hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

No vanadium related news for the month.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTC:OTCPK:SYAAF) (OTC:SRHYY)

- Triton Minerals [ASX:TON] [GR:1TG]

- Battery Minerals [ASX:BAT]

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTCPK:DMNKF)

Other listed vanadium juniors

- Golden Deeps [ASX:GED]

- Sabre Resources [ASX:SBR]

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Venus Metals [ASX:VMC]

- Intermin Resources [ASX:IRC]

- Vanadium One Energy Corp. [TSXV:VONE] [GR:9VR1] (OTC:VDMRF)

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Maxtech Ventures [CSE:MVT]

- Pursuit Minerals [ASX:PUR]

- Victory Metals [TSXV:VMX]

- BlackRock Metals (Private)

- Gladiator Resources [ASX:GLA]

- Sabre Resources [ASX:SBR]

- Vanadium One Iron [TSXV:VONE]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Cellcube Energy Storage [TSXV:CUBE] (STNUF)

- Invinity Energy Systems (LSE:IES) (OTC:IVVGF)

Conclusion

China vanadium spot prices were not updated (?flat) in November.

Highlights for the month include:

- The case for vanadium storage batteries is picking up speed.

- Flow battery to be paired with solar at South African vanadium mine’s microgrid system.

- How PV-plus-Storage will compete with gas generation in the U.S.

- President-elect Joe Biden is preparing proposals that aim to put the U.S. on a pathway toward a net-zero power system by 2035.

- Increased infrastructure spending in China has resulted in higher steel production, supporting vanadium demand; however European demand is weak and USA demand is constrained.

- United States Department of Commerce (“DOC”) is reviewing a petition by industry participants that requests a 40% tariff on vanadium imports from all sources and the establishment of a stockpiling program.

- Shell & AMG recycling B.V. sign agreement with Shandong Yulong Petrochemical Co., Ltd to assess building a spent residue upgrading catalyst recycling facility. AMG’s second ferrovanadium plant in Zanesville, Ohio is proceeding as planned. AMG announces investment in solid state battery material pilot plant to complement its state-of-the-art battery materials laboratory.

- Bushveld Vanadium Group sales for 9M 2020 of 2,987 mtV was 74 per cent higher than 9M 2019 (9M 2019: 1,719 mtV), as a result of the inclusion of sales from Vanchem.

- Largo Resources record production of 3,092 tonnes of V2O5, an increase of 5.0% over Q3 2019.

- Energy Fuels is now debt free with strong working capital and inventory.

- Neometals pilot plant achieves vanadium recoveries exceeding 75% and exceptional product purity of greater than 99.5% V2O5.

- Technology Metals Australia premium iron–vanadium concentrate produced LoI with Sinosteel Australia for life of mine offtake and EPC.

- TNG has established a Vanadium Redox Flow Battery (“VRFB”) business.

- Vanadium Resources Limited Scoping Study results confirm viability of production of vanadium pentoxide from the Steelpoortdrift Vanadium Project.

- VanadiumCorp reports Lac Dore Mineral Resource Estimate (MRE)….Lac Doré Mineral Resource Estimate (MRE): 214.93 MILLION Tonnes Grading 24.6% Magnetite and 1.3% v2o5 in Magnetite Concentrate (equivalent to 1.49 Billion Pounds of Vanadium pentoxide contained).

As usual all comments are welcome.

PS: If you are a company covered in this monthly news you can help support the service by joining Trend Investing here.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I’ve done, especially in the electric vehicle and EV metals sector. You can learn more by reading “The Trend Investing Difference“, “Subscriber Feedback On Trend Investing”, or sign up here.

Latest articles:

- Top 5 Lithium Miners To Accumulate In 2020 & 2021

- Fisker Inc. Offers A Great Early Bet For Those Investors That Missed Out On Tesla, Nio, Or XPeng

Disclosure: I am/we are long Glencore [LSX:GLEN], AMG Advanced Metallurgical Group NV [AMS:AMG], LARGO RESOURCES [TSX:LGO], NEOMETALS [ASX:NMT], Australian Vanadium [ASX:AVL], SYRAH RESOURCES [ASX:SYR], TRITON MINERALS [ASX:TON], Silver Elephant Mining Corp. [TSX:ELEF]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

www.seekingalpha.com