www.ferroalloynet.com: This week, the vanadium market is in a stalemate, but this week, the decline of V2O5 flake is temporarily stopped and stabilized, the decline of ferrovanadium market is slowing down, and the profit margin of processing manufacturers is gradually expanding. However, under the situation of weak demand, the trading quantity is limited, and the actual operation of manufacturers is still under pressure. The heat of purchasing VN alloy before the festival is far lower than the market expectation. There are only few procurement from steel plants in the days before the festival, and there are not many terminal inquiries. The actual orders and shipment of VN alloy manufacturers are not as expected. The bulk market is still active under the condition that the large V2O5 flake factories do not release goods. In addition, the ultra-high import volume in August shown by the customs data, the market is more worried about the oversupply in the future market and has insufficient confidence in the market after the festival, therefore, some suppliers sold at a low price.

1. Summary of Vanadium Bidding in September

|

Company |

Products |

Price ( CNY/T) |

Quantity ( Ton) |

Remarks |

Date |

|

A Steel Mill in Shandong |

FeV50 |

107000 |

60 |

Acceptance with Tax |

Sep 2nd |

|

Echeng Steel |

VN16 |

163800 |

20 |

Acceptance with Tax |

Sep 2nd |

|

Fujian Sanming Steel |

VN16 |

157500 |

30 |

Cash with Tax |

Sep 2nd |

|

Anhui Changjiang |

VN16 |

160000 |

140 |

Acceptance with Tax |

Sep 3rd |

|

Nanjing Steel |

VN16 |

161000 |

60 |

Acceptance with Tax, including bidding service fee |

Sep 3rd |

|

Shaoguan Steel |

VN16 |

160000 |

80 |

Acceptance with Tax |

Sep 3rd |

|

Shougang Changzhi |

VN16 |

160000 |

20 |

Acceptance with Tax |

Sep 4th |

|

JISCO |

VN16 |

157500 |

70 |

Acceptance with Tax |

Sep 7th |

|

JISCO |

FeV50 |

104800 |

20 |

Acceptance with Tax |

Sep 7th |

|

JISCO Yuzhong Steel |

VN16 |

162000 |

90 |

Acceptance with Tax |

Sep 7th |

|

ZENITH |

VN16 |

157000 |

120 |

Acceptance with Tax |

Sep 7th |

|

Guangxi Liuzhou Steel |

VN16 |

159000 |

20 |

Acceptance with Tax |

Sep 8th |

|

Shougang Changzhi |

VN16 |

156000 |

20 |

Acceptance with Tax |

Sep 11th |

|

A Steel Mill in Liaoning |

VN16 |

159500 |

30 |

Acceptance with Tax |

Sep 11th |

|

Shaoguan Steel |

VN16 |

155000 |

80 |

Acceptance with Tax |

Sep 14th |

|

Anyang Yongxing |

VN16 |

155000 |

80 |

Acceptance with Tax |

Sep 15th |

|

Shougang Changzhi |

VN16 |

152200 |

20 |

Acceptance with Tax |

Sep 18th |

|

Nanjing Steel |

FeV50 |

99950 |

30 |

Acceptance with Tax, including bidding service fee |

Sep 22nd |

|

JISCO |

VN16 |

148900 |

80 |

Acceptance with Tax |

Sep 25th |

|

JISCO Yuzhong Steel |

VN16 |

151500 |

120 |

Acceptance with Tax |

Sep 25th |

|

JISCO |

FeV50 |

101800 |

30 |

Acceptance with Tax, including bidding service fee |

Sep 25th |

|

Tonghua Steel |

VN16 |

151500 |

20 |

Acceptance with Tax |

Sep 25th |

|

Kunming Steel |

VN16 |

144300 |

20 |

Cash with Tax |

Sep 28th |

|

Kunming Steel |

VN16 |

144500 |

10 |

Cash with Tax |

Sep 28th |

|

Kunming Steel |

VN16 |

144200 |

10 |

Cash with Tax |

Sep 28th |

|

A Steel Mill in Shandong |

VN16 |

146300 |

200 |

Acceptance with Tax |

Sep 28th |

|

A Steel Mill in Shandong |

FeV50 |

100000 |

30 |

Acceptance with Tax |

Sep 28th |

2. China vanadium market overview

Ammonium metavanadate market

This week, the price of ammonium metavanadate continued to weaken slightly. Although the price of V2O5 flake stabilized this week, there was no further pressure on ammonium metavanadate. However, the price of ammonium metavanadate manufacturers was more resistant to the price drop from the price below 100000 yuan. Therefore, the price drop rate was slightly slower than that of V2O5 flake. At present, the market price of ammonium metavanadate was 92000-93000 yuan / ton by cash, and the willingness of manufacturers to ship was very low, and some manufacturers began to maintain the price at 95000 yuan / ton, and small factories are not willing to sell at a loss. Therefore, no matter whether the V2O5 flake continues to decline or not, ammonium metavanadate for chemical industry is expected to stop falling and maintain above 90000 yuan / ton. If the market price is lower, it is difficult for stone coal manufacturers and slag processing manufacturers to produce normally.

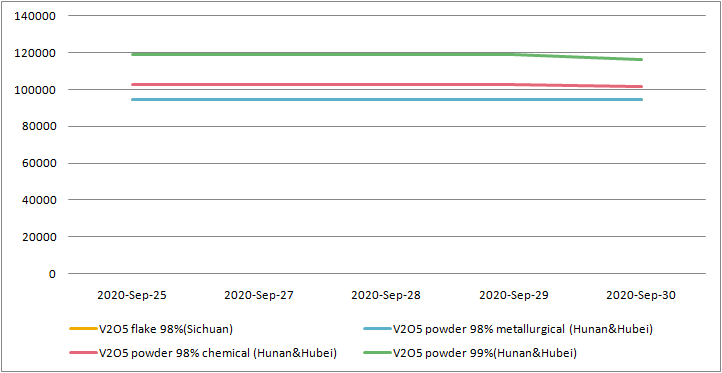

Vanadium pentoxide market

This week, the market of V2O5 flake has been running steadily, and the market atmosphere has changed from strong to weak. However, due to the fact that large factories have not lowered their quotations and have not delivered goods, the retail supply will not be in excess, but the prices of ferrovanadium and VN alloy have continued to decline this week, so there is no support for the price rise of V2O5 flake. Under the influence of both sides, the market price of V2O5 flake remained at about 94500-95000 yuan / ton by cash this week. The vanadium market also depends on the pricing of large factories after the festival. If the price is set at a price which is relatively advantageous to the retail goods, the shipment will be relatively smooth, then the retail market will face the price reduction in order to promote the transaction. Therefore, in the general direction, the price of V2O5 flake may still have downward space after the festival.

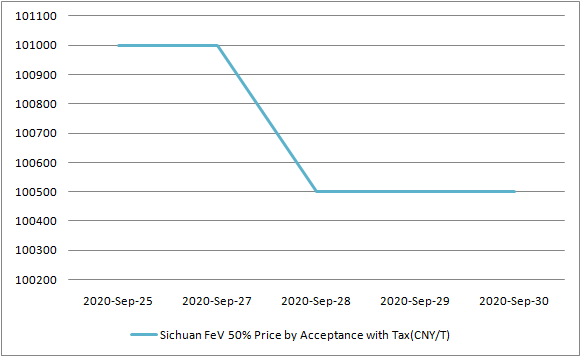

Ferrovanadium market

The main feature of ferrovanadium market this week is “less procurement and transaction”, and the spot quotation is forced to be adjusted to a low level. The traders who have goods in the early stage have a lot of losses in this stage. In terms of profit space, ferrovanadium is more efficient than VN alloy, but in terms of terminal demand and consumption, ferrovanadium market has been at a low level for a long time. Therefore, although the FeV manufacturers may have profits, the quantities of orders are less.

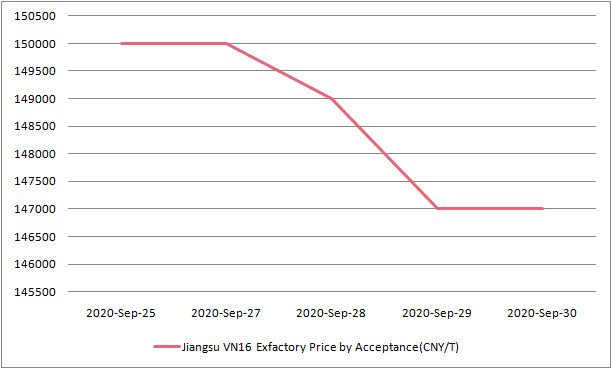

Vanadium-nitrogen alloy market

This week, VN alloy market has the biggest decline among all vanadium products. Due to the coming of the double festival holiday, the market has great expectations for stock preparation of steel mills before the festival, and even some manufacturers have prepared enough raw materials in advance to wait for bidding of steel plants and receive orders. However, this round of procurement is relatively few, and the bidding of mainstream steel mills is less, and the procurement plan of some steel mills is delayed. Manufacturers with inventory begin to sell spot goods before the festival, and the quotation is decreasing. At present, the market price of VN alloy is reduced to about 146000 yuan / ton by acceptance. The manufacturers are not optimistic about the market after the festival, and the excess supply is difficult to consume.

3. Vanadium worldwide market review

On 25 Sep, the price of ferrovanadium in the European market maintained at 24.45-25.0 USD/kgV, convert into 50# ferrovanadium RMB price was 83,300-85,200 Yuan/ton. The price of European V2O5 was 5.1-5.6 USD/LB V2O5, convert into V2O5 98% RMB price was 75,100-82,400 Yuan/ton; the price of ferrovanadium in United States was 10-10.5 USD/LB V, convert into 50# ferrovanadium RMB price was 75,100-78,800 Yuan/ton.

4. Forecast on next week

The National Day and Mid Autumn Festival holiday is around the corner. The next natural week is in the holiday, the actual transaction activity is not expected to be much. The market is expected to postpone the situation before the festival. The next working week starts on October 9, and the market will enter the middle of the month. Due to the few procurement before the festival, some alloy manufacturers are looking forward to purchasing after the festival. However, this month, Tranvic and Desheng have a small amount of goods sold, the inventory at the end of the month is high, and the normal production is accumulated during the holiday. How to price and sell the spot stock of large V2O5 flake factories after the festival has a great impact on the market. In September, with a small number of large factories shipping, the V2O5 flake can still meet the production of alloy manufacturers, and can be purchased at low prices. The phenomenon of oversupply is obvious. In mid October, the purchase of steel mills may increase, but it is difficult to consume all the accumulated supply in October, the volume of imported vanadium products in October is expected to remain at a relatively high level. With the long accumulation of excess supply in the domestic market since June, the digestion is also a long process in the later market. In addition, when the domestic market fell seriously in September, the mainstream raw material plants did not show any signs of reducing production, maintaining full production capacity, and there are still concerns in the follow-up market. Judging from supply and demand, vanadium market still has downward space.

www.ferroalloynet.com