The COVID-19 coronavirus pandemic didn’t just put pressure on the economic performance of most companies, it also overshadowed the success of others.

Case in point: Vanadium One Iron Corp. (TSX-V: VONE, OTC: VDMRF, Forum).

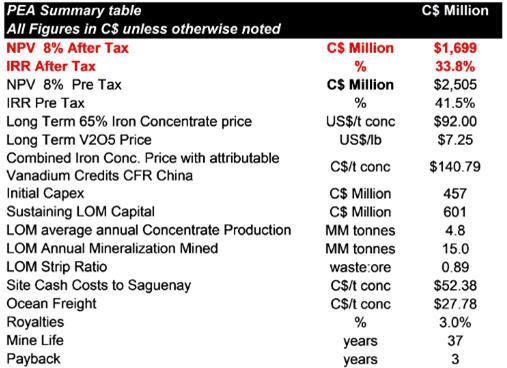

Back in April, the Canadian mineral exploration Company published a Preliminary Economic Assessment with a near-present value (NPV) of

These findings were detailed in its technical Report entitled “NI 43-101 Technical Report – Preliminary Economic Assessment (PEA) of the Mont Sorcier Project, Province of Quebec, Canada”.

Further findings:

- After Tax NPV@8% of $1.7 Billion (CAD) with an IRR of 34%

- Initial Capex $457.5 million (CAD)

- Payback period of three years at long term metal prices

- Current Mineral Resource Estimate supports a potential mine life of 37 years

- Total Site Operating costs of $52.38/t (CAD) of concentrate over potential LOM

- Annual operating profit margins estimated at $60/t at long term consensus and over $85/t at current spot prices

- Upside potential from resource expansion and the potential to expand production

(Chart via Vanadium One Iron Corp.)

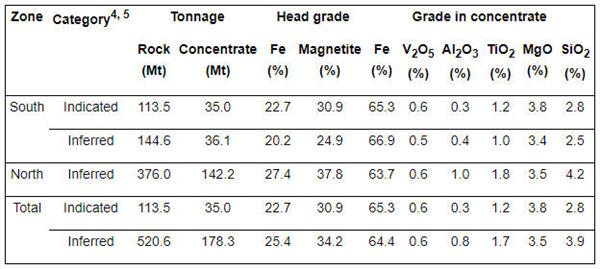

Mineral Resource Estimate1 at Mont Sorcier Using a Cut-off Grade2 of 14% Fe:

Vanadium One’s has just commenced its 2020 drill program at Mont Sorcier, targeting to expand the current resource base and deliver a new Mineral Resource Estimate (MRE) by Q1 2021. This drill program aims to increase the current resources to a minimum of between 900 million to 1.1 billion tonnes at grades of between 24-34% magnetite. Moreover, these results are intended to enhance the value presented in the PEA.

Vanadium One Iron’s President and Chief Executive Officer, Cliff Hale-Sanders expressed pleasure to be going back into the field to enhance the potential the Company sees in the Mont Sorcier project.

“We believe an expanded resource base in conjunction with the robust economics outlined in the PEA earlier this year should be very supportive in our efforts to enter into a strategic partnership to develop Mont Sorcier into a long life, highly profitable iron and vanadium mine.”

The Company’s current resource shown below but cautioned that the expanded resource target is conceptual in nature as there has been insufficient exploration to define a new mineral resource.

(Chart via Vanadium One Iron Corp.)

- Numbers have been rounded to reflect the precision of Inferred and Indicated Mineral Resource estimates.

- The reporting cut-off was calculated for a magnetite concentrate containing 65% Fe with price of $US 90/t of dry concentrate, 50% of the price of V2O5 contained in the concentrate, a V2O5 price of $US 14/lb, a minimum of 0.2 % of V2O5 contained in the concentrate, an open pit mining operation, a cost of mining and milling feed mineralization of USD 13.80/t, a cost of transporting concentrate of USD 40/t; and a cost of tailing disposal of USD 1.5/t.

- Vanadium One is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing or political factors that might materially affect these mineral resource estimates.

- Resource classification, as defined by the Canadian Institute of Mining, Metallurgy and Petroleum in their document “CIM Definition Standards for Mineral Resources and Mineral Reserves” of May 10, 2014.

- Mineral Resources are not Mineral Reserves and by definition do not demonstrate economic viability. This MRE includes inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

The 3,500-metre drill program will cover more than 1.5 kilometers along strike and will highlight the continuation of ultramafic host rocks. The program will include standard core logging, assaying and Davis tube analysis to determine ore grades and expected concentrate grades.

Stock performance:

The Company’s stock performance has navigated these COVID waters well, bouncing back from the common March 2020 crater that a lot of other companies endured and is now higher than it sat this time, last year. That said this was prior to releasing the results of the PEA and despite iron ore prices outperforming gold price year to date as the global economy recovers and infrastructure development remains a focus.

(Vanadium One Iron Corp. stock chart – Sept 2019 – Sept 2020. Click to enlarge.)

Here is a Company getting back to work and show off the true value of its key assets. Investors should keep their eye out for further updates coming from Vanadium One Iron Corp. as the Company releases details on its vanadium-rich magnetite Mont Sorcier Iron and Vanadium Project.

For more information about the Company, visit www.vanadiumone.com.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.

www.stockhouse.com