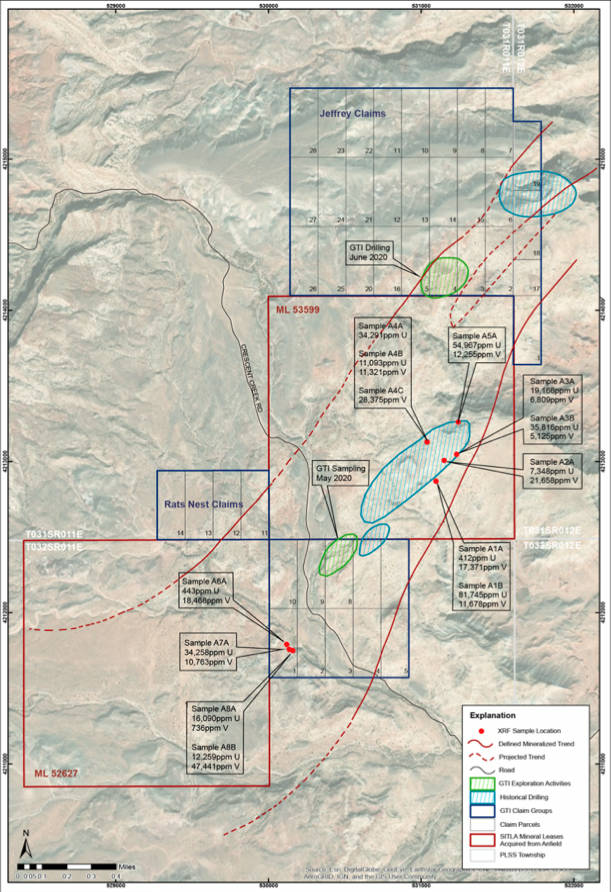

Special Report: GTI has more than doubled its footprint around the Jeffrey and Rats Nest projects as it seeks to lock-in a potential 5.5km uranium-vanadium trend between the two areas.

Additionally, the newly acquired leases have past production and are prospective for near surface uranium and vanadium mineralisation.

GTI Resources (ASX:GTR) said recent XRF sampling from historical shallow underground workings on the new leases returned results of up to 81,745 parts per million (ppm), or more than 8 per cent, uranium and 28,375ppm vanadium.

While XRF readings only provide an on-the-spot analysis that is not considered as reliable as laboratory assays, the results do provide evidence of potential high-grade uranium and vanadium mineralisation on the new leases.

Mineralisation in the new claims appears to be consistent with the historically mined mineralisation within the Salt Wash Member across the Colorado Plateau.

The company will pay the vendors an initial 2 million GTR shares and $US100,000 ($143,333) for the two new leases and will be required to issue a further 2 million GTR shares and $US100,000 within 14 days of the first anniversary of settlement.

Executive director Bruce Lane says the new leases give GTI an enhanced ground position by securing the prospective ground between its two projects.

“The new ground substantially increases the interpreted mineralised strike zone within GTI’s land package and materially enhances the opportunity to define an economic resource in the area,” he added.

“The mineralised trend which was confirmed during our recent round of drilling at Jeffrey remains open in both directions and in particular to the south which runs into the new leases.

“The initial sampling conducted on the new leases shows prospectivity for commercial grade ores and the possibility that exploration and development could be relatively quick and inexpensive.”

Positive drilling leads to land grab

The acquisition follows the company’s recent drilling program at the Jeffrey project that confirmed the projected geometry of the mineralised trend, which remains open in both directions along strike.

Downhole gamma logging returned up to 3,535ppm uranium, while XRF sampling of the drill core yielded results of up to 26,388ppm vanadium. Laboratory assays are still pending.

Drilling also indicated that there was a second, deeper mineralised horizon in the southern area of the Jeffrey group adjacent to the neighbouring property.

GTI is now planning the next phase of drilling, which it plans to expand as quickly as possible to include the new leases.

Fast tracking gold hunt

GTI has more than one string to its bow. The company is also planning to carry out further work at its Niagara gold project in Western Australia.

This follows Metalicity’s (ASX:MCT) successful exploration drilling at its Kookynie project about 2km to 4km north of GTI’s project that returned up to 10m at 3.21 grams per tonne (g/t) gold from 26m, 3m at 4.59g/t from 31m and 4m at 3.69g/t from 23m.

GTI says its neighbour’s success has encouraged it to accelerate the next phase of exploration drill targeting at Niagara while planning for the next phase of uranium-vanadium drilling in Utah is finalised.

To help fund the acquisition and accelerate its exploration programs, the company is raising $1.8m through a share placement priced at 3c per share.

The company is also offering a share purchase plan to current shareholders that is underwritten to a maximum amount of $978,000.

www.stockhead.com.au