www.ferroalloynet.com: At present, the domestic vanadium market is generally in a strong trend, among which the products with more active market performance are V2O5 flakes and VN alloys, which also drives the ammonium polyvanadate and ammonium metavanadate in the upstream to show a slight strong trend. However, the prices of chemical V2O5 powder and ferrovanadium are moderate and stable due to the weak inquiry, so the main driving force for the future market to continue to be strong are the increase of V2O5 flakes and VN alloys price.

1. The transaction price of V2O5 flakes increased, which led to the increase of the price of ammonium vanadate

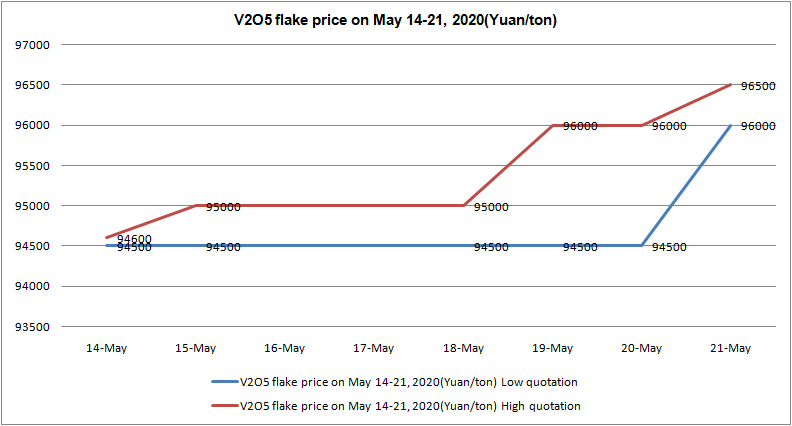

At present, there are very few quotations and shipments in the V2O5 flake market. Suppliers who have stocks mainly wait and see, some of them offer to 98,000 Yuan/ton in cash, and a small number of hoarders say they received inquiry of 97,000 Yuan/ton, but the main transaction in the market is 96,000 Yuan/ton. Some purchasers urgently need to purchase, and the price up to 96,500 Yuan/ton, but only a small amount of transactions, and most of the spot goods are unified bullish with higher offer. Influenced by the price fluctuation of V2O5 flakes, the inquiry of metallurgical grade ammonium metavanadate and ammonium polyvanadate increased, and the market price slightly increased. The manufacturers quoted at 93,000 Yuan/ton in cash and 95,000 Yuan/ton by acceptance, and the transaction price of ammonium metavanadate was as high as 83,000 Yuan/ton with tax, and slightly lower between 82,000-82,500 Yuan/ton.

2. The main trading of VN alloy held steady for a while

In recent days, the performance of VN alloy is mainly firm, and the price is difficult to rise by a breakthrough when the inquiry is temporarily reduced. However, the market quotation is basically maintained at 150,000-152,000 Yuan/ton in cash, and some suppliers directly supply to steel plants have high prices at 154,000-155,000 Yuan/ton by acceptance price and 153,000 Yuan/ton in cash. The alloy plants are still optimistic about the future market, due to the rise of bulk V2O5 flakes price, vanadium alloy manufacturers must be alert to the fact that the future raw materials continue to rise, which will compress the profit space, or whether the large factories will increase the quotation next month. Therefore, VN alloy factories mainly sign the orders based on existing raw materials, and the spot inventory of the manufacturers is still in a downward trend. It is expected that the bidding price will be strong at the end of the month. Compared with the active VN alloy, the inquiry in the ferrovanadium market is relatively rare. Most manufacturers in the Northeast area cut output and mainly supply to old customers. Some manufacturers report that there are few new inquiries. The transaction price of ferrovanadium in the bulk market is 101,000 Yuan/ton in cash, and the manufacturer’s quotation is mainly at 101,000-103,000 Yuan/ton. The price is stable and hard to fluctuate further.

3. High rebar price, high raw material cost to support market

Affected by the rising prices of raw steel scrap and iron ore, the profit of rebar has been compressed to a certain extent, but on the other hand, the steel price has also been strengthened. From the perspective of the rising trend of the price, the price of rebar has reached a high level, the range of increase has slowed down, and the price is high. There is still room for the increase of rebar production in a short period of time, and the terminal demand for VN alloy will not be weakened temporarily.

www.ferroalloynet.com