Summary

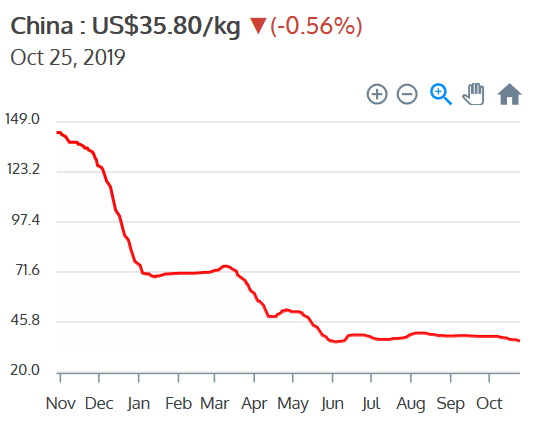

Vanadium spot prices were lower in October.

Vanadium market news – Short-term demand is down; however, expert says flow batteries are potentially going to be a big contributor in grid-level stationary energy storage.

Vanadium company news – AMG signs multi-year contract to supply available production to Glencore.

I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Welcome to Vanadium miners news. October saw vanadium prices lower and steady progress by the vanadium miners and juniors.

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

China Vanadium Pentoxide [V2O5] Flake 98{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Price = USD 7.90/lb

China Ferrovanadium [FeV] 80{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Price = USD 35.80

Source: Vanadiumprice.com

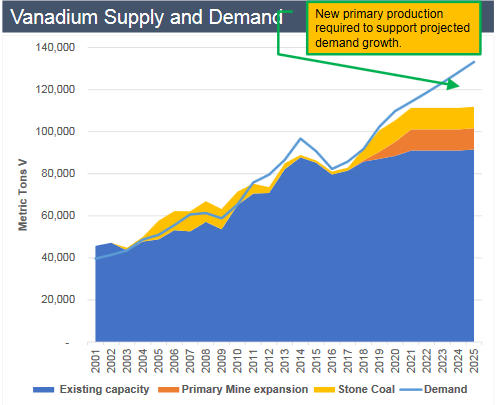

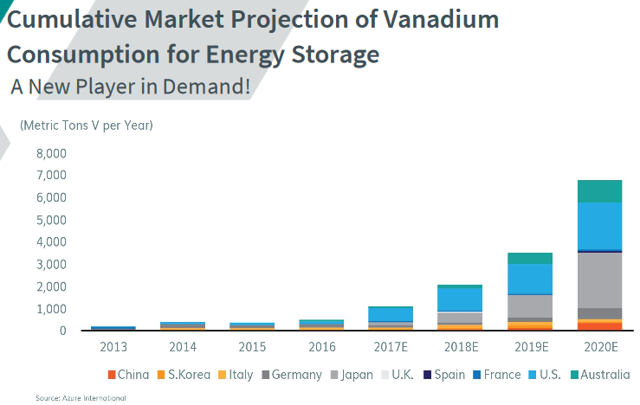

Vanadium demand versus supply

The charts below show energy storage to be a new source of vanadium demand, and overall demand looks likely to grow very strongly to 2025.

Vanadium total demand forecast to outstrip supply 2020-2025

Source: Technology Metals Australia investor presentation & TTP Squared

Roskill estimates that vanadium demand “for VRFB markets” could rise to 31,000 tons by 2025, amounting to a rise of 3,100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} in a decade.

Source: Australian Vanadium presentation

Vanadium market news

In 2017, Robert Friedland stated:

We think there’s a revolution coming in vanadium redox flow batteries,” he says. “You’ll have to get into the mining business and produce ultra-pure vanadium electrolyte for those batteries on a massive scale. We’re very deeply interested in how you store electrical energy in the grid. The beauty of the vanadium redox battery is that you can charge and discharge it at the same time, something that can’t be done with a lithium battery. With a vanadium redox flow battery, you can put solar power and wind power into the battery, and you can put excess grid power into the battery at night, and at the same time you can have a stable output into the grid.

On September 18, Engerati reported:

Hybrid battery systems: The best of both worlds. Lithium-ion batteries make up the lion’s share of installed non-hydro storage systems so far, but flow batteries have some benefits that can provide complementary services when the two are co-located. “By combining the two technologies, you can utilise the relative strengths of both,” says Ed Porter, Commercial Director, redT energy. The flow machine element is designed to be the ‘first port of call’ for the system essentially picking up the heavy utilisation work and able to store up to 6 hours of excess solar power or run through 3-4 cycles per day. The lithium battery then covers the final power requirements – minimising the amount of times you need to call on them, whilst maximising the use of the heavy-cycling asset, the flow machines.

On September 28, PV Magazine reported:

Flow batteries scale up to GW production. Plans for a gigawatt factory in Saudi Arabia, bullet-proof warranties and an international vanadium rental service are propelling a new generation of batteries into the energy storage big league. Pioneers of redox flow technology claim that they can put an end to the degradation and safety issues afflicting lithium-ion batteries. They also expect imminent economies of scale to reduce the cost of bulk energy storage and unlock new markets for solar power.

On October 9, Vanadium Corp. posted an article from June by the Australian Energy Council:

Batteries going with the flow. Australia is one of the fastest-growing energy storage markets in the world with the most mature storage technologies being pumped hydro and lithium-ion batteries[i]. But other technologies have been developing in the background – such as flow batteries – which provide opportunities in larger-scale applications. It was recently reported that Australia’s chief scientist Alan Finkel, believes that flow batteries are potentially going to be a big contributor in grid-level stationary energy storage. Flow batteries, in particular, offer an opportunity to make renewable storage more affordable and could help to grow the industry – increasing the prospects for utility-scale development of solar energy storage.

On October 19, Fastmarkets reported: Ferro-vanadium continues downtrend amid poor demand; V2O5 follows alloy market lower.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

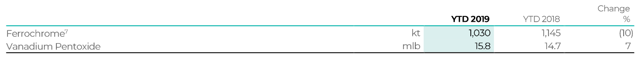

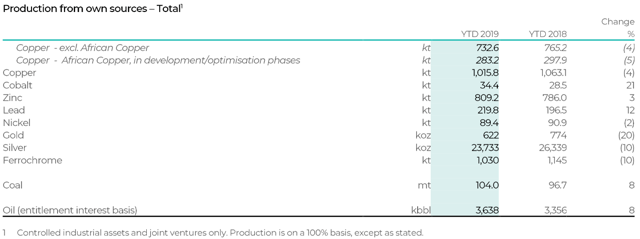

On October 25, Glencore announced: “Third quarter 2019 production report.” Vanadium Pentoxide production YTD 2019 was 15.8mlbs, 7{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} higher than 2018 YTD.

Glencore 2019 YTD production compared to 2018 YTD (from own sources)

On October 25, Glencore announced:

Glencore one of seven mining, metals companies to partner on responsible sourcing with World Economic Forum…..The Mining and Metals Blockchain Initiative will explore the building of a blockchain platform to address transparency, the track and tracing of materials, the reporting of carbon emissions or increasing efficiency……In addition to Glencore, Antofagasta Minerals, Eurasian Resources Group Sàrl, Klöckner & Co, Minsur SA, Tata Steel Limited, Anglo American/De Beers (Tracr), are founding members.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

On September 26, Advanced Metallurgical Group NV announced:

AMG signs multi-year contract to supply available production to Glencore.”

On October 8, Advanced Metallurgical Group NV announced:

“AMG Advanced Metallurgical Group N.V. and Shell Catalysts & Technologies agree to form Shell & AMG recycling B.V. The joint venture will provide a long-term sustainable solution for catalyst reclamation and recycling. With the implementation of the IMO 2020 fuel sulfur regulation we expect significant spent-catalyst volume growth. The end-to-end option that will be available to oil refineries will represent an outstanding CO2 reduction opportunity.”

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On October 21, Bushveld Minerals Limited announced:

Mokopane Mining right application granted. Bushveld Minerals……The Company will now finalise the financial provision requirements and concurrently implement an agreed revised shareholding structure, in accordance with Mining Charter III, that will see five percent of the equity in Pamish sold by the existing shareholders (Bushveld Minerals and Izingwe Capital Limited) to the Bakenberg Community Trust, a trust established for the benefit of the local communities. The five percent is to be vendor-financed and repaid from future proceeds from the mine.

On October 23, Bushveld Minerals Limited announced:

Vanchem acquisition completion update. The Company is pleased to announce that it has renegotiated the consideration payable for the acquisition with the sellers and that the initial conditions to closure of the transaction have been met. The total consideration has been reduced from US$68 million to US$53.5 million, of which US$30 million will be payable in cash and the balance through the issue of Bushveld Minerals unsecured convertible loan notes.

On October 23, Bushveld Minerals Limited announced: “Early settlement of the Yellow Dragon earn-out.”

You can view the latest investor presentation here.

Largo Resources [TSX:LGO] [GR:LR81] (OTCQX:LGORF)

Largo Resources is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil.

On October 15, Largo Resources announced: “Largo Resources announces record V2O5 production of 2,952 tonnes in Q3 2019.” Highlights include:

- “Record V2O5 production of 2,952 tonnes in Q3 2019, an increase of 17{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} over Q2 2019 and 15{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} over Q3 2018.

- Global V2O5 recovery rate2 of 78.1{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} in Q3 2019 compared to 79.1{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} in Q2 2019 and 77.1{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} in Q3 2018.

- Average annual cash operating costs excluding royalties1 guidance lowered to US$3.30 to $3.40 per pound of V2O5; Production guidance maintained.

- Expansion project in final stages of commissioning; Expected to conclude in October 2019.”

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio,” as well as being a recent vanadium producer.

No vanadium news for the month.

Ferro Alloy Resources [LON:FAR]

No vanadium news for the month.

Vanadium developers

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

No vanadium news for the month.

Investors can read the latest company presentation here.

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On October 4, Neometals announced: “Development agreement for Barrambie Project.” Highlights include:

- “MOU with China’s IMUMR to jointly evaluate and potentially develop Barrambie Titanium-Vanadium Project.

- MOU sets out a pathway towards a commercial production JV.

- IMUMR is a recognised leading metallurgical institute in China with acknowledged expertise and relations with global titanium-vanadium production houses.

- Agreement supports Neometals’ strategy of attracting strong partners to realise value from its globally significant assets.”

On October 17, Neometals announced: “MoU to commercialise lithium-ion battery recycling process with global partner.”

You can view the latest investor presentation here, or “An Update On Neometals,” or my article – “Neometals Managing Director Chris Reed Gives A Brief Update With Matt Bohlsen Of Trend Investing.”

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia.

On October 17, Australian Vanadium announced:

VSUN Energy sells vanadium Redox Flow Battery to Victorian dairy farmer. Solar and storage system offers reduced green energy price…..AVL’s subsidiary, VSUN Energy Pty Ltd, has secured an order for an 80kW/320kWh vanadium Redox Flow Battery.

On October 25, Australian Vanadium announced:

Drilling program completed at the Australian Vanadium Project. First drilling program targeting Mineral Resource extensions and upgrades completed…..Mineral Resource update to follow receipt of assays, incorporating latest RC drill results and diamond drill results from early 2019.Further drill programs in advanced planning stage, targeting southern blocks to convert current Inferred Resources to Indicated Resources.

Catalysts include:

- Q4 2019 – Resource upgrade due.

- December 2019 – DFS due.

You can view the latest investor presentation here, or read “Australian Vanadium Managing Director Vincent Algar Talks With Matt Bohlsen Of Trend Investing.”

Technology Metals Australia [ASX:TMT]

The company’s primary exploration focus is on the 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

On October 1, Technology Metals Australia announced: “Offtake MoU with leading Chinese vanadium nitrogen producer.” Highlights include:

- Memorandum of understanding executed with Shaanxi Fengyuan Vanadium Technology Development Co, Ltd.

- Fengyuan is one of China’s leading producers of vanadium nitrogen alloy [VN] with production capacity of 10,000 tpa VN.

- MoU establishes the framework for a binding V205 offtake agreement covering 3,000 tpa of TMT’s proposed average 12,800 tpa V2O5 production.

- The agreement is intended to be finalised in the coming months.

- TMT now has approximately 40{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} of proposed average annual production covered under offtake MoU’s.”

On October 9, Technology Metals Australia announced:

Gabanintha Vanadium Project advances to NAIF funding due diligence phase. Technology Metals Australia Limited is pleased to advise that the Northern Australia Infrastructure Facility (“NAIF”) has completed its strategic assessment of the Gabanintha Vanadium Project (“Project” or“GVP”) and has advised that the GVP has proceeded to the Due Diligence Stage of the NAIF assessment process. NAIF is a A$5 billion facility set up as an initiative of the Australian Federal Government to provide loans, which may be on concessional terms, to support and encourage infrastructure development in northern Australia.

Catalysts include:

- 2019 – Further off-take announcements.

- 2020 – Funding or equity partner announcements.

You can view the latest investor presentation here, or read “Technology Metals Australia Execetive Director Ian Prentice Talks With Matt Bohlsen Of Trend Investing.”

TNG Ltd [ASX:TNG] [GR:HJI] (TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd. is well advanced with a massive $4.7b NPV8{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}, but relies on titanium and iron with a lower grade vanadium by-product.

On October 8, TNG Ltd. announced: “TNG submits mining management plan for the Mount Peake Project mine site.”

On October 14, TNG Ltd. announced:

September 2019 quarterly activities report. Mount Peake FEED process advanced. Optimised delivery strategy and revised financial model completed. Premium iron ore strategy confirmed. Project development team expanded MMP submitted. EIS nearing completion.

On October 23, TNG Ltd. announced: “TNG announces intention to seek a dual listing on the main market of the London Stock Exchange.”

On October 25, TNG Ltd. announced:

European patent granted for TNG’s proprietary Tivan® process for extraction of vanadium. Approval for China in progress with patents already in place in Australia, Canada, the Russian Federation, the USA and Vietnam.

You can view the latest investor video presentations here.

Aura Energy [ASX:AEE] [GR:VU1] (OTC:AUEEF)

Aura Energy is an Australian-based minerals company that 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owns polymetallic and uranium projects with large resources in Sweden (Häggån Project) and Mauritania (Tiris project). Aura’s focus is on the Häggån Project, located in Sweden’s Alum Shale Province, one of the largest depositories of vanadium in the world.

On September 25, Aura Energy announced:

Technical and finance update for Tiris Project. Additional water drilling yielding good results. Post DFS enhancement Projects commenced. Aura receives positive initial feedback on export credit agency [ECA] finance process.

On October 10, Aura Energy announced:

Häggån Battery Metals Project. Resource upgrade estimate successfully completed. Indicated resource of 320 million lbs V2O5 at 0.35{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5. High-grade vanadium zone confirmed from surface to approx. 100 metres depth…..This has resulted in a new Global Resource of 2 Billion tonnes at an average grade of 0.3{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5, containing 13.3 Billion lbs V2O5, at a 0.2{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 cutoff, which includes 320 million lbs V2O5 at 0.35{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 as Indicated Resource, and 13.0 Billion lbs V2O5 at 0.3{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 as Inferred Resource.

You can view the latest investor presentation here.

Prophecy Development Corp. [TSX:PCY] (OTCQX:PRPCF)

Prophecy Development Corp. is a Canadian public company listed on the Toronto Stock Exchange. Prophecy’s objective is to advance the Gibellini Black Shale primary vanadium project in the Battle Mountain region in northeastern Nevada to production. Gibellini aims to be the first active primary vanadium mine in North America.

No vanadium news, but their promising Pulacayo silver project received an approved and signed mining production contract. You can read more here.

On October 21, Prophecy Development Corp. announced:

Prophecy closes $3,900,000 private placement with Eric Sprott, who now owns 9{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d}.

You can view the latest investor presentation here.

Vanadium Resources Limited [ASX:VR8] (formerly Tando Resources [ASX:TNO])

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold, zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

On September 25, Vanadium Resources Limited announced: “Outstanding reserve drilling results further demonstrate quality of steelpoortdrift vanadium project.” Highlights include:

- “First results from reserve drilling continue to demonstrate the high grade nature of the Steelpoortdrift Vanadium Project.

- Consistent high in situ grades of +1.0{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 in LMZ including: 15m at 1.08{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5. 11m at 0.96{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5. 9m at 1.05{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5. 7m at 1.11{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5.

- Reserve drilling programme has now been completed with all samples delivered to the laboratory.

- Results will be used to upgrade the Mineral Resource for Steelpoortdrift in Q4.”

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

On October 25, King River Copper announced: “Quarterly activities report 30 September 2019.” Highlights include:

- “The Speewah Specialty Metals [SSM] Project Prefeasibility Study has progressed based on a smaller scale Beneficiation-Agitated Tank Sulphuric Acid leaching-precipitation process to produce the following high value products: High purity alumina 99.99{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Al2O3 [4N HPA]. Vanadium pentoxide [98{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5] Titanium dioxide 80{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} TiO2. Iron oxide 67{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Fe2O3. Testwork and studies are underway to deliver a Prefeasibility Study towards the end of 2019.

- Additional Mt Remarkable Exploration Licences granted, and field work and drilling commenced.

- Two new Tennant Creek Exploration Licences applied for and drilling is planned for next quarter.”

You can view the latest investor presentation here.

Vanadiumcorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:APAFF)

Vanadiumcorp Resource Inc. 100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has another smaller project known as the Iron-T Vanadium Project also in Quebec, and royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

On September 30, Vanadiumcorp Resource Inc. announced:

VanadiumCorp VRFB facility to open in Germany. VanadiumCorp Resource Inc. is pleased to announce its plans to open a vanadium redox flow battery “VRB”, “VRFB” research and development facility in Karlsruhe, Germany, focused on next generation flow battery innovation. “We are in detailed negotiations with potential manufacturers and end users. An engineering team of industry veterans will be led by our new Chief Technology Officer, Dr. Gilles Champagne.” commented, Adriaan Bakker, Chief Executive Officer of VanadiumCorp.”

On October 15, Vanadiumcorp Resource Inc. announced: “VanadiumCorp completes 37 drill holes (9,598 m) at Lac Doré, Québec.”

On October 17, Vanadiumcorp Resource Inc. announced: “VanadiumCorp & Electrochem expand the intellectual property portfolio into the European Union.”

You can view the latest investor presentation here.

First Vanadium Corp. [TSXV:FVAN] (FVANF) (formerly Cornerstone Metals Inc.)

Cornerstone’s Carlin Vanadium project hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a historic Inferred Resource 28Mt at 0.525{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 (2010 SRK).

On October 7, First Vanadium Corp. announced:

First Vanadium engages Wood Canada Limited to prepare a preliminary economic assessment for the Carlin Vanadium Project in Nevada.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTC:OTCPK:SYAAF) (OTC:SRHYY)

- Triton Minerals [ASX:TON] [GR:1TG]

- Battery Minerals [ASX:BAT]

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTCPK:DMNKF)

Other vanadium juniors

- Cellcube Energy Storage [TSXV:CUBE] (STNUF)

- Golden Deeps [ASX:GED]

- Sabre Resources [ASX:SBR]

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Venus Metals [ASX:VMC]

- Intermin Resources [ASX:IRC]

- Vanadium One Energy Corp. [TSXV:VONE] [GR:9VR1] (OTC:VDMRF)

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Maxtech Ventures [CSE:MVT]

- Pursuit Minerals [ASX:PUR]

- Victory Metals [TSXV:VMX]

- BlackRock Metals (Private)

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Cellcube Energy Storage [TSXV:CUBE] (STNUF)

Conclusion

Vanadium spot prices were lower in October.

Highlights for the month include:

- Ferro-vanadium continues downtrend amid poor demand; V2O5 follows alloy market lower.

- Vanadium flow batteries have some benefits that can provide complementary services when co-located with Li-ion batteries.

- Flow batteries scale up to GW production. Plans for a gigawatt factory in Saudi Arabia.

- Australia’s chief scientist Alan Finkel, believes that flow batteries are potentially going to be a big contributor in grid-level stationary energy storage.

- Glencore V2O5 production YTD 2019 was 15.8mlbs, 7{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} higher than 2018 YTD.

- AMG signs multi-year contract to supply available production to Glencore. AMG and Shell Catalysts & Technologies for a JV to provide a long-term sustainable solution for catalyst reclamation and recycling.

- Bushveld Minerals – Mokopane Mining right application granted. Bushveld renegotiates the Vanchem acquisition (from US$68m to US$53.5m).

- Largo Resources announces record V2O5 production of 2,952 tonnes in Q3 2019… operating costs guidance lowered.

- Neometals signs MOU with China’s IMUMR to jointly evaluate and potentially develop Barrambie Titanium-Vanadium Project.

- Technology Metals Australia – Offtake MoU with leading Chinese vanadium nitrogen producer Shaanxi Fengyuan Vanadium Technology Development Co, Ltd.

- Aura Energy resource upgrade for their Häggån Project in Sweden – 320 million lbs V2O5 at 0.35{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 as Indicated Resource, and 13.0 Billion lbs V2O5 at 0.3{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} V2O5 as Inferred Resource.

- Vanadiumcorp Resource Inc. plans to open a vanadium redox flow battery research and development facility in Karlsruhe, Germany.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I’ve done, especially in the electric vehicle and EV metals sector. You can learn more by reading “The Trend Investing Difference,” “Subscriber Feedback On Trend Investing,” or sign up here.

Latest Trend Investing articles:

- The ESPO Video Gaming And eSports ETF Offers Broad Exposure To Gaming

- An Update On What’s Happening With 5G And The Global Rollout And What Stocks To Consider

Disclosure: I am/we are long GLENCORE [LSX:GLEN], AMG ADVANCED METALLURGICAL GROUP NV [AMS:AMG], LARGO RESOURCES [TSX:LGO], NEOMETALS [ASX:NMT], AUSTRALIAN VANADIUM [ASX:AVL],TECHNOLOGY METALS AUSTRALIA [ASX:TMT], SYRAH RESOURCES [ASX:SYR], TRITON MINERALS [ASX:TON]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

www.seekingalpha.com