By Steve Saville,

https://www.speculative-investor.com/new/weeklye0moqf170619.html

In the 27th May Weekly Update, under the heading “The most relentless decline ever”, we wrote:

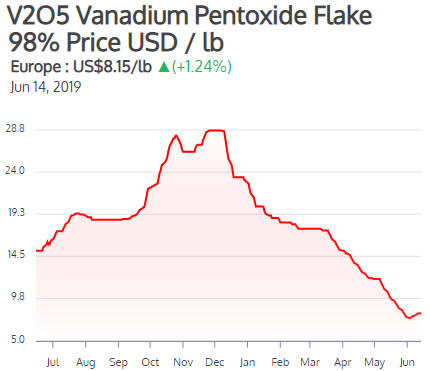

“The price of vanadium pentoxide (V2O5) in Europe has not had an up-day since 26th November of last year. Apart from 30-40 ‘unch’ days, since then it has dropped on every trading day. We’ve never seen anything like this.“

The “most relentless decline ever” ended on 4th June. Since then, the vanadium pentoxide price in Europe has edged up from US$7.50/pound to US$8.15/pound.

There are no technical or sentiment indicators that can give us clues regarding what to expect from the vanadium price over the next several months. That’s because price is determined by supply from the mining industry relative to demand from industrial users (steel manufacturers, mostly). We suspect that supply from the mining industry is roughly the same now as it was a year ago and won’t change by much over the next year, so the price will be driven by changes in industrial demand.

Our guess is that the industrial demand for vanadium will increase over the next six months due to the rebuilding of stockpiles that were drawn down over the past six months and new Chinese rebar standards coming into full effect. This should result in an upward bias in the price, but not the sort of spectacular rally that occurred in 2018.

If you don’t have any exposure to vanadium it would be reasonable to add some. In this regard it’s worth revisiting Largo Resources (LGO.TO), a profitable vanadium producer operating the Maracas mine in Brazil.

In the 22nd April Weekly Update we wrote that due to its recent price action LGO had become a worthwhile moderate-risk speculation. At that time the LGO price was in the C$1.60s and the vanadium price was around US$12. Despite the vanadium price now being about 30% lower, the LGO price is almost 20% higher and clearly has broken upward from the channel drawn on the following daily chart.

We think that LGO would be a good candidate for new buying if it were to pull back to near its 50-day MA (currently at C$1.76). Also, Prophecy Development Corp. (PCY.TO), an exploration-stage vanadium miner and a member of the TSI Small Stocks Watch List, would be a reasonable speculation below C$0.20.