Date: Jan 29, 2019

Summary

Vanadium spot prices fell heavily in January.

Vanadium market news – Roskill estimates that vanadium demand for VRFB markets could rise to 31,000 tons by 2025, amounting to a rise of 3,100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} in a decade.

Vanadium company news – Largo Resources agrees to repurchase additional US$47.8 million of debt, followed a week later with an additional US$8.1m.

Looking for a portfolio of ideas like this one? Members of Trend Investing get exclusive access to our model portfolio. Get started today »

Welcome to Vanadium miners news. January saw vanadium China spot prices continue to fall and appear to stabilize above US$ 15/lb V2O5. News flow was slow for the month.

For some background you can read my earlier articles:

- March 16, 2018 – A Look At The Vanadium Boom And Vanadium Miners

- April 5, 2018 – Top 5 Vanadium Miners To Invest In The Vanadium Boom

- October 29, 2018 – A Brief Update On The Vanadium Boom

Vanadium uses

Vanadium is traditionally used to harden steel. However Vanadium Flow Batteries (VRFBs) are becoming increasingly popular especially for commercial energy storage, most notably in China.

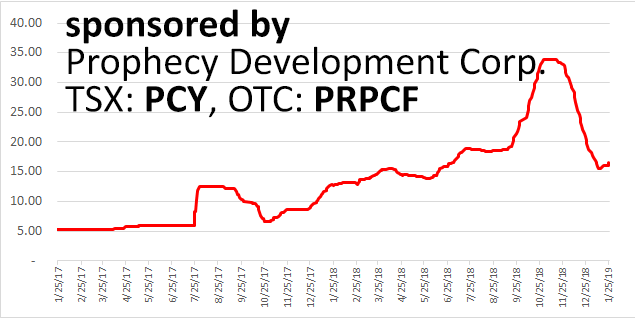

Vanadium oxide spot price history

China Vanadium Pentoxide [V2O5] Flake 98{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} Price – USD 16.60/lb

Vanadium demand versus supply

The charts below show energy storage to be a new source of vanadium demand, and overall demand looks likely to grow very strongly to 2025.

Roskill estimates that vanadium demand for VRFB markets could rise to 31,000 tons by 2025, amounting to a rise of 3,100{3a701354f219a57e7e7d46a505b70225e975b940de2dd07556e20488ab77339d} in a decade.