Date: Aug 22, 2017

Spot prices for ferro-vanadium and vanadium pentoxide consolidated their gains across China, Europe and the USA last week, underpinned by pockets of tightness and Chinese buying, both in and outside China.

– Chinese buying fuels price growth in the cif and European duty-unpaid markets

– Seasonally weak demand from consumers keeps ferro-vanadium and V2O5 prices stable, despite limited inventories

– Inactivity in US spot market hinders price growth

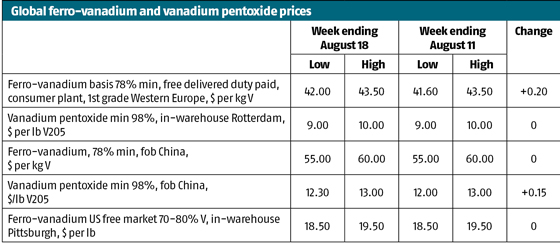

Ferro-vanadium prices were up by 0.5% in Europe at the end of last week, now quoted at $42-43.50 per kg, delivered duty-paid, according to Metal Bulletin’s assessment on August 18, compared with $41.60-43.50 per kg on August 16.

The price rally in the European duty-paid market has slowed after a soaring Chinese market and a spate of trader buying facilitated a 54% jump in prices in the second half of July. Sellers are now waiting for end-users to return to the market after the summer break for activity to pick up once again.

For the time being, however, sellers are successfully targeting progressively higher prices for each enquiry, typically for five to ten tonnes of material given the summer slowdown, but nonetheless allowing the market to consolidate its recent gains.

“It looks like the spilling over of environmental inspections in further Chinese provinces is making traders edgy,” a producer source said.

Market participants in Europe are looking to China for price direction in the coming weeks, and in particular, firm news on whether vanadium producers will be given permission to resume their operations in September.

Seasonally weak demand and the uncertain supply outlook is, for the time being, limiting the scope for further price gains in the European duty-paid market, despite stocks being fairly tight.

“It’s less liquid; we were buying selling all the time a few weeks ago,” a trader said.

The tight supply environment is more acute in the more active duty-unpaid market, sources said.

“That’s evident when looking at our stock levels; we have more flexibility to offer duty-paid than duty-unpaid ferro-vanadium,” the trader added.

Chinese buyers are in the market either taking advantage of an open arbitrage window to ship material back to China, or looking to buy in order to fulfil their sales commitments elsewhere globally.

Duty-unpaid buyers also looking for larger volumes, for which sellers can command a premium when supplies are tight.

As a result, the expected 2.7% differential between the duty-unpaid and duty-paid market has been eroded, with duty-unpaid trades being concluded either at parity or at a slight premium to duty-paid transactions.

In Europe, V2O5 prices held at $9-10 per lb, in-warehouse Rotterdam, on August 18, keeping in line with the relatively slower increase in ferro-vanadium prices in the region compared with China.

European V2O5 prices could come under pressure from an eagerness to sell, compared with elevated Chinese export numbers, given a lack of spot demand in recent weeks, market participants warned.

“If there’s one piece of spot business in Europe, it might go closer to $10 per lb, if sellers are aggressive to try to secure the sale,” a second trader said.

Meanwhile, the Chinese vanadium market has quietened over the past two weeks following a surge in domestic prices for the material during the second half of July. The rally – which saw prices double – has suppressed downstream demand, resulting in limited trading activity in the Chinese market.

However, supply of vanadium in China’s domestic market is set to tighten further after several plants in another important production hub, Hubei province, were ordered to halt production for 40 days to undergo facility upgrades. These closures come after a number of plants in Sichuan province were ordered to suspend production in July following environmental inspections.

According to historical data, vanadium output in Sichuan province accounts for more than 60% of China’s total production, so any production stoppages in the province could led to a significant loss of supply, with the potential to push prices higher.

Sources told Metal Bulletin that the production halt in Hubei province will remove another 200-300 tonnes of vanadium from the spot market for each month that production is suspended.

Metal Bulletin’s latest assessment for the fob China ferro-vanadium min 78% price was unchanged at $55-60 per kg V on August 17, with some offers heard at $65 per kg, based on domestic spot closing prices.

Meanwhile, the fob China V2O5 min 98% price rose by 1.2% last to $12.3-13 per kg V2O5 on August 17, according to Metal Bulletin’s latest assessment.

However, as Chinese prices are far above those in other regions, the country’s export market has not seen any deals since earlier this year.

“We will not accept lower than our offer price to sell in export market as the closing prices in domestic market are good and we are not eager to sell with a tight supply outlook,” a market source said.

Meanwhile, the US ferro-vanadium market continued to flatline, as market activity remained dormant.

US spot prices for ferro-vanadium held at $18.5-19.5 per lb on August 17, according to Metal Bulletin sister publication AMM’s latest assessment.

For the second consecutive week, inactivity in the spot market stunted further price growth after a precipitous rise over prior weeks.

“Trading activity is very sparse in the USA right now,” a supplier source told AMM. “We could see higher numbers in the USA, but there’s not enough data points to pick at on the sale side.”

While consumers continue to sit on the sidelines, market participants expressed concern regarding whether prices were sustainable given current demand levels.

“This is all driven by environmental inspections causing supply issues in China, and is not demand driven,” a second supplier source said.

“No one knows what the outcome of these environmental inspections will be in terms of the long-term impact. We need to see if consumer demand returns in September to see know if these prices are sustainable,” he added.